As interest mounts about the nature of farm-in agreements in South America’s newest oil and gas hotspot – Guyana – OilNOW takes a look this week at what the term means, why it is used and to what extent do companies enter such deals in the petroleum industry.

A farm-out agreement operates as a type of sale and purchase agreement under which a seller (the “farmor”) agrees to transfer part (but not all) of its interest in an upstream asset to the buyer (the “farmee”), in exchange for that buyer agreeing to undertake (or fund) work obligations such as acquiring seismic data or drilling wells in respect of that asset. In the context of the oil and gas industry, the upstream “asset” being transferred is usually an interest in a license, production sharing contract, or other concession, granted by a government to a company to explore for and produce oil and gas.

In June 2019, the oil and gas industry body, the Association of International Petroleum Negotiators (AIPN), published a revised version of its model form international farm-out agreement. The publication of this new model form agreement is a reflection of the increased sophistication, and continuing evolution, of the farm-out market.

A company may decide to enter into a farmout agreement with a third party if it wants to maintain its interest in an exploration block or drilling acreage but wants to reduce its risk or doesn’t have the money to undertake the operations that are desirable for that interest. Farmout agreements give farmees a potential profit opportunity that they would not otherwise have access to.

AIPN states that government approval may be necessary before a farmout deal can be finalized, which is the case in Guyana. As recently as May 2019 authorities announced that government approval was granted for the farm-in joint venture agreement between CGX Energy and Frontera Energy Corporation for exploration in the Corentyne and Demerara offshore blocks.

Farmout agreements are very popular with smaller oil and gas producers who own or have rights to oil fields that are expensive or difficult to develop. One company that makes frequent use of this type of arrangement is Kosmos Energy (NYSE: KOS). Kosmos has rights to acreage off the coast of Ghana, but the cost and risk to develop these resources is high because they are under water. To help reduce these risks, Kosmos “farmsout” its acreage to third parties like Hess (HES), Tullow Oil and BP. Doing so allows these offshore blocks to be developed and generate cash flow for all the parties involved.

A farmee like Hess takes on the obligation to develop the field and, in return, has the right to sell oil that is produced there. Kosmos, as the farmor, earns a royalty payment from Hess for supplying the acreage and the natural resource.

Farmout agreements are effective risk management tools for smaller oil companies. Without them, some oil fields would simply remain undeveloped due to the high risks facing any single operator.

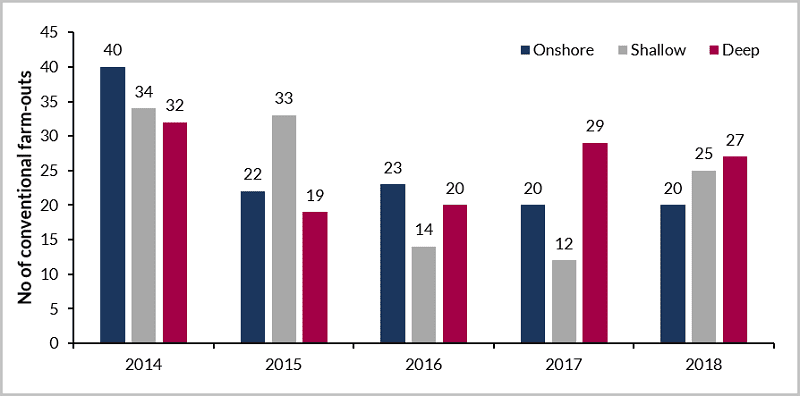

Westwood Global Energy Group says since the start of 2014, 191 companies have been active in the exploration farm-in market. During the 5-year period, the most active farm-in company was Total who completed 15 deals, whilst the most active farm-out company has been Tullow who completed 19.