Guyana has become the bedrock of ExxonMobil’s post-COVID corporate revival, an Aug 1 piece by Bloomberg’s Kevin Crowley outlined.

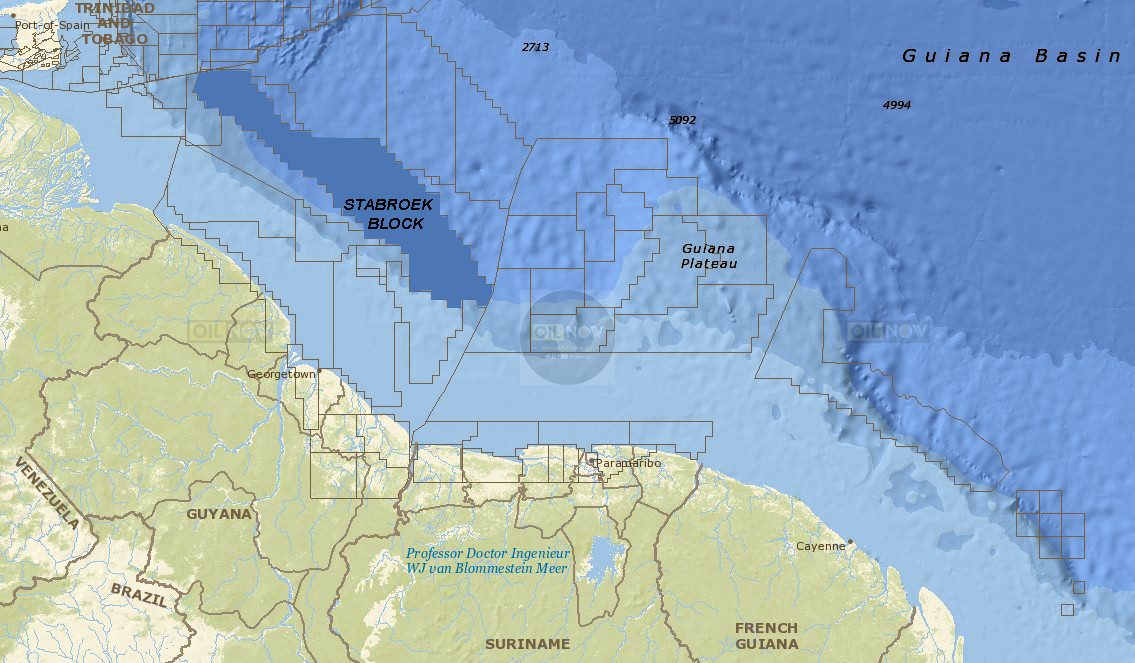

The Texas oil giant is the operator with a 45% stake in the Stabroek Block, a vast oil field spanning 6.6 million acres. Hess and CNOOC are the other shareholders. Production costs there are less than US$35 a barrel, making it “one of the most profitable fields outside OPEC”. With crude currently trading at US$85 a barrel, Bloomberg predicts that the field would remain profitable even if oil prices dropped by half due to a collapse in demand from the transition to renewable energy.

Exxon has three projects in operation at the Stabroek Block: Liza 1, Liza 2, and Payara. The company also has two incoming projects, Yellowtail and Uaru, and a sixth project, Whiptail, was recently sanctioned. Exxon is now seeking approval for its seventh project, Hammerhead.

Five Stabroek Block projects have industry-leading breakevens in range of US$25-35 per barrel Brent

The success of the Stabroek Block is a cornerstone of Exxon’s strategy.

“When everyone else was pulling back, we were leaning in,” says Liam Mallon, President of Exxon’s Upstream division. The company’s shares have more than doubled since production began in late 2019, the highest return among its supermajor peers.