By Joel Bhagwandin – OilNOW

There has been quite some misunderstanding and misinterpretation with respect to the accounting treatment of the decommissioning liability for the oil companies as reflected in their balance sheets. This article seeks to offer some clarity on the decommissioning provisions which is a future liability that is part of the business model of the oil companies.

Decommissioning Methodology and Cost Evaluation

The decommissioning of offshore oil and gas facilities presents many challenges throughout all parts of the operation. Development of new and innovative structures to explore and produce in deeper waters has been followed by continued development of new methods and techniques to remove those facilities when they reach the end of their productive lives. The historical performance of decommissioning projects provides useful guidance in developing cost estimates for future projects. The uncertainties of offshore work mean that cost estimates will never be perfect due to ocean and weather conditions beyond the operator’s control, but a structured approach to cost estimation and periodic benchmarking against actual projects affords the best approach for operators to determine reasonable decommissioning cost estimates.

Explanation of Decommissioning Provisions/Accounting Treatment

The decommissioning provision is recognised as an estimate of costs of dismantling and removing fixed assets and restoration of the site/environment on which it is located. This is an essential aspect of the business model for oil and gas companies. The amount recognised for decommissioning costs is the present value of the expected future decommissioning costs which is calculated as future cost x discount factor. The unwinding of the discount of the dismantlement provision is included as a finance cost in the profit and loss account.

Important, the accounting treatment of the decommissioning provision affects the balance sheet where the fixed asset value is increased by the amount provided and the corresponding entry is on the liability side of the balance sheet. Moreover, the decommissioning cost is a capitalised expenditure which means, it is not an expenditure deducted from the profit and loss account which would effectively reduce the profit share – rather the transaction affects the asset and liability side on the balance sheet. When the decommissioning cost is incurred – the accounting treatment would be a reduction in asset value (current asset component, where cash will be reduced), and the corresponding entry would be on the liability side to clear the liability balance. Thus, given that the cost is a capital expenditure, it essentially comes from the oil companies’ share of profit (reinvested into the company) and not Guyana’s share of profit. Consequently, the decommissioning liability has a minimal to zero impact on Guyana’s share of profit oil.

Additionally, given that the fixed asset value on the balance sheet is depreciated over time and the depreciation amount is an expense item on the profit and loss account – it therefore means that the amount by which the fixed asset value is increased on the balance sheet is subject to depreciation deductions on the profit and loss account.

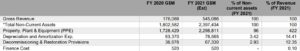

Against this background, the decommissioning provisions as illustrated in the tables below, the estimated depreciation and finance expense for the decommissioning liability, represents 0.47% of gross revenue for FY 2021. This means that the decommissioning expense has less than one percent impact on profit oil, while the total provision for FY 2021 represents 14% of revenue and 3% of total non-current assets.

Conclusion / Summary

The depreciation and financing expenses attributed to the decommissioning (provision) liability represents less than one percent of gross revenue – thus having almost zero impact on profit oil. Similarly, financing cost represents less than one percent of gross revenue due to the low level of debt financing employed in the capital structure of the oil companies. The decommissioning provision is a balance sheet item which affects both the fixed asset and liability side, and has a minimal to virtually zero impact on Guyana’s share of profit oil. In other words, the full sum of decommissioning provision which is approximately US$357m up to FY 2021 is not a deductible from profit oil as has been incorrectly reported and misconstrued by a certain section of the media and other analysts.

About the Author

Joel Bhagwandin is a financial and economic analyst, an academic researcher and writer, a junior business executive, lecturer, and thought leader. Joel is actively engaged in providing insights and analyses on a range of public policy, economic and macro-finance issues in Guyana for the past 5+ years. In this regard, he has authored more than 300 articles covering a variety of thematic areas. Joel possesses more than fourteen years’ experience in the financial sector and private sector development combined. During this time, he has accumulated more than five years of professional experience in providing financial and business advice to both large corporations and Small and Medium sized Enterprises (SMEs) and eight years’ managerial experience. Academically, Mr. Bhagwandin is the holder of a master’s degree in business management with specialisation in banking and finance from Edinburgh Napier University. His specialties and skills include: Corporate Finance, Banking, Capital Markets & Securities, Business Intelligence & Data Analysis.