While the sale of crude from the Liza Field in Guyana and in neighbouring Trinidad and Tobago (T&T) has not shared the same fate as US oil, former Energy Minister of Trinidad and Tobago, Kevin Ramnarine, says the Caribbean oil producing neighbours will be watching Brent futures closely in coming weeks.

The fall of oil futures to below $0 on Monday is a United States (US) ‘market phenomenon’ directly affecting the West Texas Intermediate (WTI) pricing standard, not the more globally used Brent North Sea crude’s valuation of the internationally traded commodity. As such, the sale of crude from the Liza Field in Guyana and in neighbouring Trinidad and Tobago (T&T) has not shared the same fate.

This, according to Ramnarine, “does not mean the Brent price will not (also) continue to slide.”

He told OilNOW; “what we are seeing here is mainly a United States oil market phenomenon…That does not mean that things are okay elsewhere.”

Ramnarine explained that in the United States, the destruction of demand for fuel—as a result of COVID-19 lockdowns—has led to a massive oversupply of crude oil, “which has to be stored somewhere.”

The former T&T Energy Minister reminded that the United States is the world’s largest producer of crude oil and WTI price, “is a creature of the United States oil market.”

He said WTI is determined at Cushing, Oklahoma in the US, which is the delivery point for the NYMEX (New York Mercantile Exchange) light sweet crude oil contracts. Ramnarine said this location is in fact land-locked with its storage capacity of 91 million barrels of oil approaching “tank-tops.”

Considering the fact that crude buyers are required to take delivery of crude oil at Cushing, Ramnarine said storage at that hub is running out as a result of falling demand.

This, in addition to the fact that WTI May contracts expired on April 21, 2020, saw traders being prepared to dump their contracts the following day, at lower prices.

“The Brent price is holding because Brent North Sea crude is sold on the sea and is hence easily traded,” he said.

According to Ramnarine, Brent oil price is considered the global price and is the basis for over two thirds of all the crude oil sold in the world.

The WTI price, he explained, “reflects the US market and (was) stopped being thought of as a global price when the shale revolution started.”

Reflecting on the region, Ramnarine reminded that “most if not all the oil sold in T&T is sold based on Brent” and that the same applies to the Liza crude produced by the ExxonMobil-led consortium in Guyana.

He noted that T&T’s revenue for 2020 was initially based on an oil price of $60 per barrel which was revised to $40 per barrel in early March 2020.

The Guyana government sold its first oil cargo in February, before the collapse of the oil prices in the US and its global concomitant effect, at $55 a barrel.

Ramnarine said however, that in T&T, “given that we sell most of our crude oil on the basis of Brent and Brent prices are well below (US) $40 per barrel and natural gas prices are also low, I expect the revenue shortfall to be much more than the TT$ 7 billion and more like TT$ 10 billion to TT$ 12 billion.”

The US’s WTI futures on Monday sunk to a negative value for the first time ever which led to traders having to pay to get oil taken off their hands.

According to a CNBC news report, wild swings in the May contract for WTI this week were thought to have been exaggerated by its imminent expiration, leaving many concerned the situation could repeat itself when the June contract expires next month.

The global volatility in the trading of the commodity comes as Guyana looks to finalise arrangements with a firm for the long-term marketing and sale of its entitlement of crude from the 120,000 bpd Liza Phase 1 Development at the Stabroek Block, operated by ExxonMobil.

Royal Dutch Shell and commodities traders Gunvor and Mercuria were among the major trading companies that have since submitted formal Expressions of Interest (EOI) in the hopes of being selected by the country’s Department of Energy (DoE).

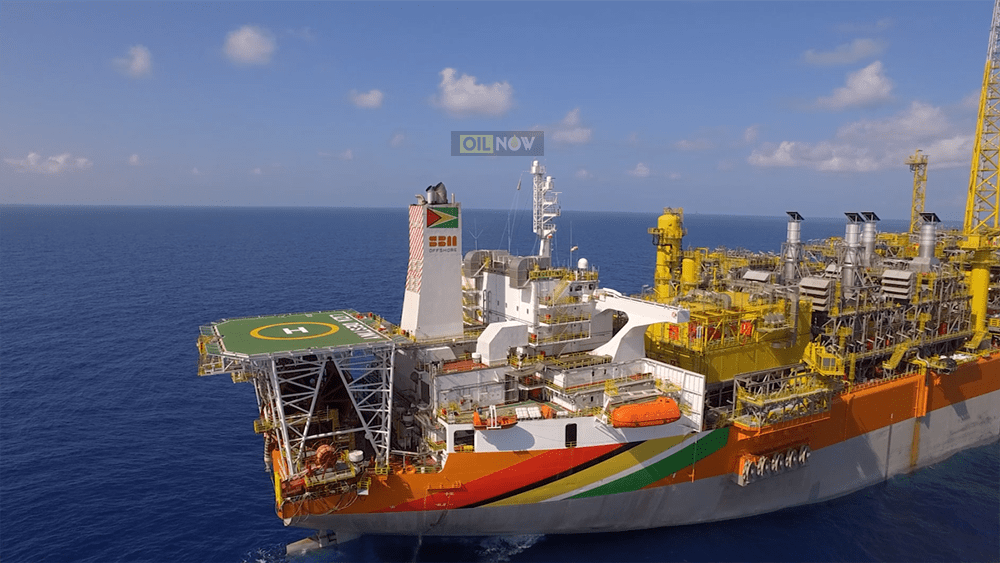

Guyana first began producing oil in late December with ExxonMobil shipping the first one million barrels of crude from the Floating Production and Storage Vessel—the Liza Destiny—in January last.

Energy expert, author and consultant, Robert McNally had told OilNOW that extreme price volatility is a key feature of the oil industry but “when the price of oil collapses, don’t panic, don’t rip up the contracts, don’t assume you are being fleeced.”

It was noted that what is certain, is that Guyana is still seen as a key location for offshore development with massive potential. ExxonMobil has found over 8 billion barrels of oil equivalent resources off the country’s coast and other companies have since made their own discoveries.