SBM Offshore has secured project financing of US$1.63 billion for the floating production, storage and offloading (FPSO) vessel Almirante Tamandaré, which is set to become Brazil’s largest oil-producing unit.

The project financing has been provided by a consortium of 13 international banks with insurance cover from four international Export Credit Agencies (ECA). The financing is composed of five separate facilities with a weighted average cost of debt of approximately 6.3% and a 14-year post-completion maturity for both the ECA-covered facilities and the uncovered facility.

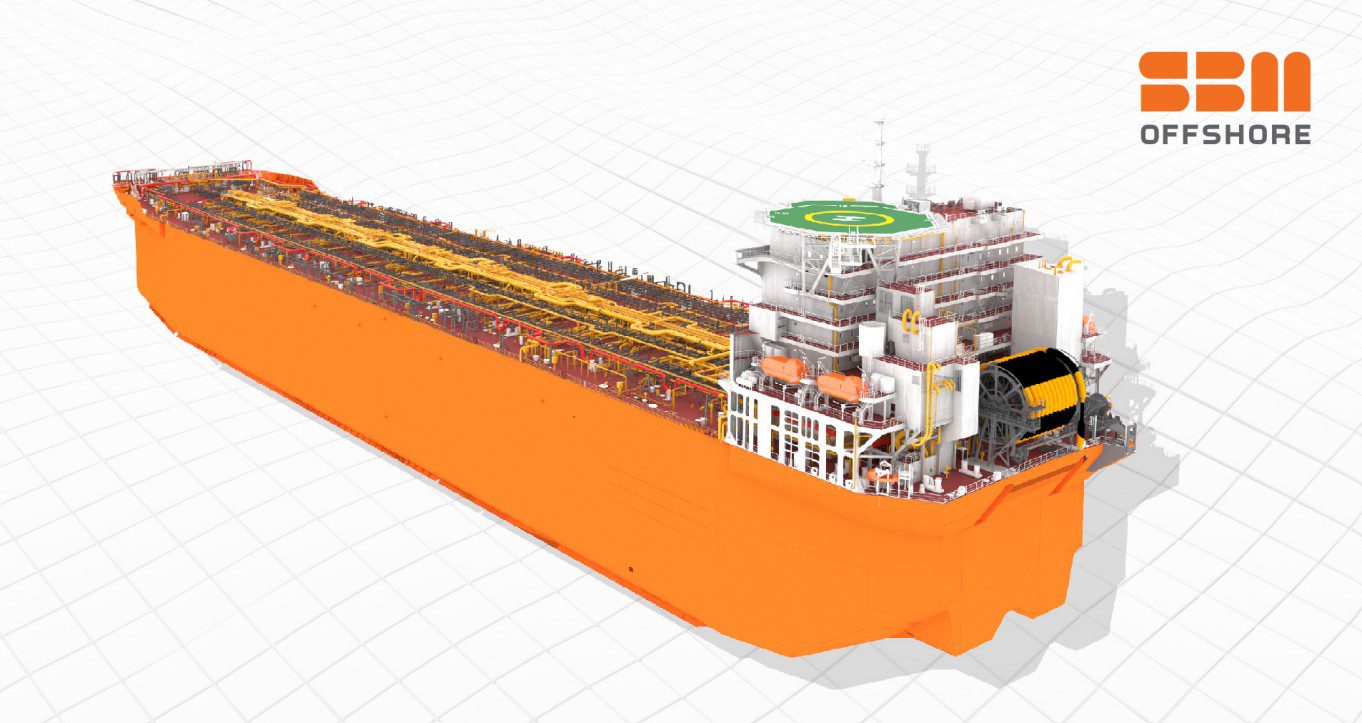

The FPSO’s design incorporates SBM Offshore’s innovative Fast4Ward® new build, multi-purpose hull. With a processing capacity of 225,000 barrels of oil and 12 million m3 of gas per day, the FPSO will be deployed at the Búzios field in the Santos Basin, approximately 180 kilometres offshore Rio de Janeiro in Brazil. It will be owned and operated by a special purpose company owned by affiliated companies of SBM Offshore (55%) and its partners (45%), and will be under a 26.25-year lease and operate contract with Petróleo Brasileiro S.A. (Petrobras). Petrobras is operating the Búzios field in partnership with CNODC and CNOOC.

The Almirante Tamandaré FPSO will have an estimated greenhouse gas (GHG) emission intensity below 10 kgCO2e/boe and will benefit from emission reduction technologies such as closed flare technology, which increases gas utilisation, preventing it from being burnt into the atmosphere. The FPSO will also contribute to Brazil’s efforts to reduce greenhouse (GHG) emissions and comply with the Paris Agreement targets.

This significant financing deal comes at a crucial time for Brazil, as the country aims to increase its oil production to meet rising demand both domestically and internationally. Furthermore, with Guyana and Brazil set to become the largest producers of crude oil in the Latin America and Caribbean region over the next decade, SBM Offshore has been charged with delivering several FPSO vessels to these countries.