Eco Atlantic Oil & Gas Ltd. has garnered approval from Guyana’s Minister of Natural Resources for its acquisition of a 60% interest in the Orinduik block from Tullow Oil. This development stems from an agreement made in August between Eco and Tullow Oil PLC (TLW), for the latter to sell its stake and operatorship to Eco.

According to a release from Eco, the agreement dictates a multi-stage payment process, with an initial US$700,000 payment followed by contingent payments tied to future results and project milestones. Upon completion of this deal, Eco will hold a commanding 75% interest altogether in the Orinduik block.

Colin Kinley, Eco’s Chief Operating Officer, expressed elation at receiving support from the Minister of Natural Resources and the Guyana government. Kinley explained that Eco is keen on exercising its operatorship for finalizing target selection which will inform future drilling.

The implications of Tullow’s Orinduik departure | OilNOW

Moreover, Eco has initiated a formal farm-out process for the block, seeking qualified partners to maximize the potential of this high-value asset. Kinley noted, “Recent interest from supermajors and other well-capitalized energy companies in the latest licensing bid round in Guyana, for blocks up-dip of us, supports our thesis of the oil migration and the high quality and charged reservoirs we see on our block.”

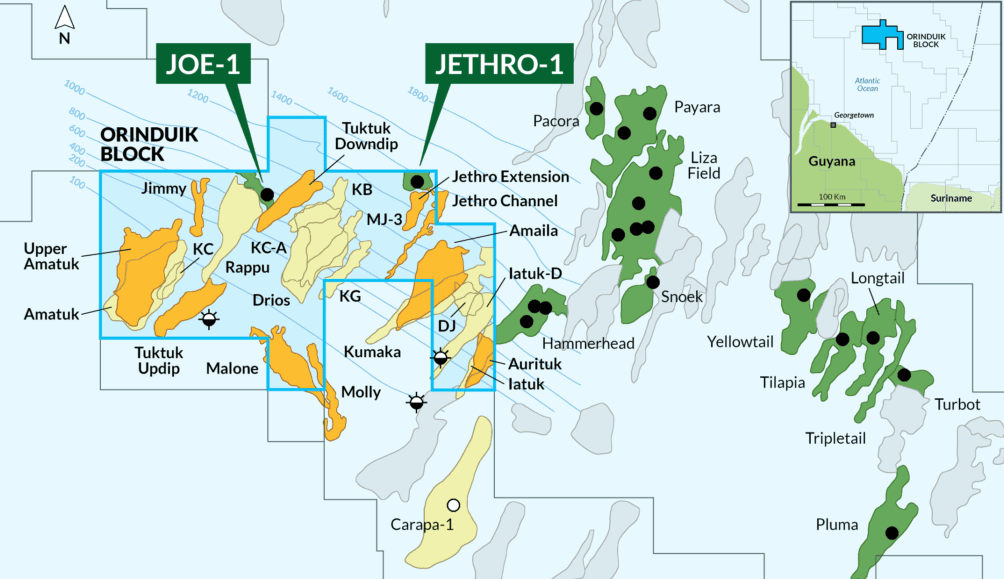

The Orinduik block’s strategic positioning adjacent to the Exxon-operated Stabroek block, housing the prolific Liza field and substantial reserves estimated at around 11 billion barrels, is the key selling point for this block.

The second and final renewal period of the Orinduik petroleum agreement started in January. Set to last three years, it requires the drilling of one exploration well. Eco Atlantic is targeting a multi-hundred million barrel stacked pay opportunity.

The remaining partner is a joint venture (TotalEnergies and Qatar Energy), which has a 25% stake.