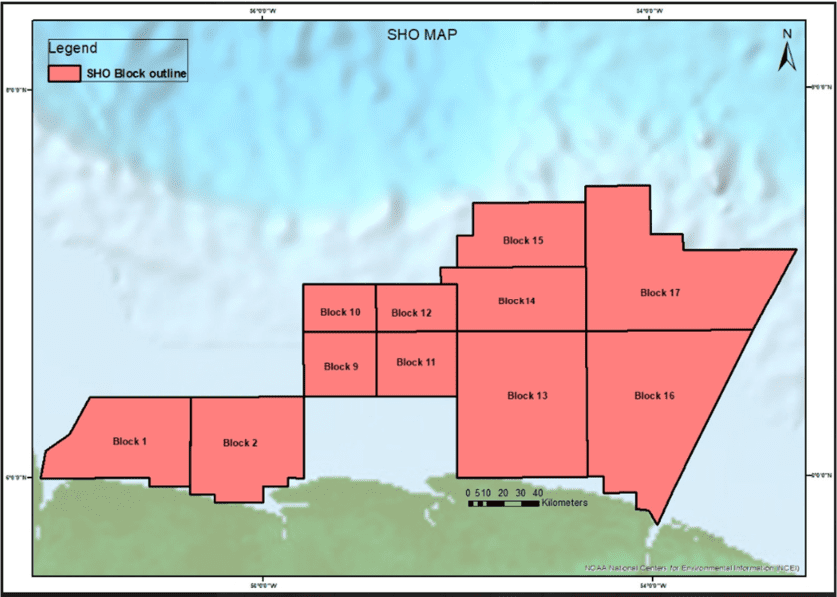

Staatsolie Hydrocarbon Institute N.V. (SHI), a subsidiary of Staatsolie Maatschappij Suriname N.V., has initiated a new opportunity for oil companies to engage in its offshore oil and gas sector. Staatsolie has announced an auction of eleven blocks within the shallow offshore open acreage, an area promising substantial oil prospects.

The blocks, situated between the onshore producing oilfields and the deepwater discoveries, fall within water depths up to 150 meters. Notably, the recent mapping on these blocks has identified over 98 leads and prospects, which, as per SHI, have been interpreted from existing 2D and newly acquired multiclient 3D seismic data. Collectively, these leads and prospects host a significant volume of oil with an aggregate mean unrisked STOIIP (stock tank oil initially in place) amounting to an impressive 91 billion barrels, Staatsolie said.

Who will supply Suriname’s first FPSO: Modec or SBM Offshore? | OilNOW

SHI has provided insights into the geochemical evaluations conducted on existing wells, revealing at least two active petroleum systems. These systems are believed to be charging the acreage on offer, enhancing the attractiveness of this bid round for potential investors.

The bid round officially opened on November 7, 2023. Interested parties can access data rooms beginning on December 18, 2023, with this window closing for new bidders on April 26, 2024. The final submission date for bids is slated for May 31, 2024, and the anticipation for the announcement of successful bidders will culminate on June 28, 2024. Following this, the signing of production sharing contracts (PSCs) is scheduled for October 31, 2024.

Petronas, Exxon hit oil jackpot with second discovery at Block 52 offshore Suriname | OilNOW

These new blocks are governed by Suriname’s petroleum legislation, which outlines the regulatory framework for exploration, appraisal, development, and production activities. Staatsolie has set clear terms for its involvement, retaining a carried equity that ranges from 10% to 30% during the exploration phase. This involvement extends to a right of participation as an equity partner in the event of a commercial discovery throughout the development and production phases.

A key aspect of the bidding process will be the point system, planned to ensure bids are evaluated fairly. In circumstances where bids tie on points for a specific block, a signature cash bonus will be requested from the bidders to determine the preferred bidder.

Suriname wants to leverage future oil royalties to extend debt repayment deadlines | OilNOW

The criteria for bids extend beyond a minimum work programme— which varies depending on the block— to include additional commitments like 3D seismic acquisition, further exploration drilling, and potentially a higher signature bonus, each serving as biddable items that can influence the final decision.