CGX Energy and Frontera Energy are expected to report to the market soon about their plans for the Corentyne block offshore Guyana. Frontera’s earnings report for the third quarter is expected on November 9, and CGX’s usually falls in the same period.

Hopes are high for a development outside of the Stabroek block, and the north Corentyne area seems like the best bet.

Total net pay at Wei-1

CGX’s drilling operations earlier this year at the Wei-1 well have yielded hydrocarbon-bearing sandstone reservoirs. Notably, the maastrichtian and campanian intervals have demonstrated a substantial net pay of 77 feet (23.5 meters).

In the santonian interval, which was the primary target, preliminary investigations, utilizing wireline logs and core samples, have identified 210 feet (64 meters) of hydrocarbon-bearing sands. These findings are yet to be confirmed as no physical samples were obtained.

To determine the net pay and establish a solid basis for evaluating the santonian interval, CGX had said it would consult an independent third-party laboratory to conduct a thorough analysis of the rock and fluid properties extracted from the Santonian core. While Guyana’s Ministry of Natural Resources said in June that this would take two to three months, four have passed. And CGX is quiet about total net pay at Wei-1.

Development prospect of Corentye block

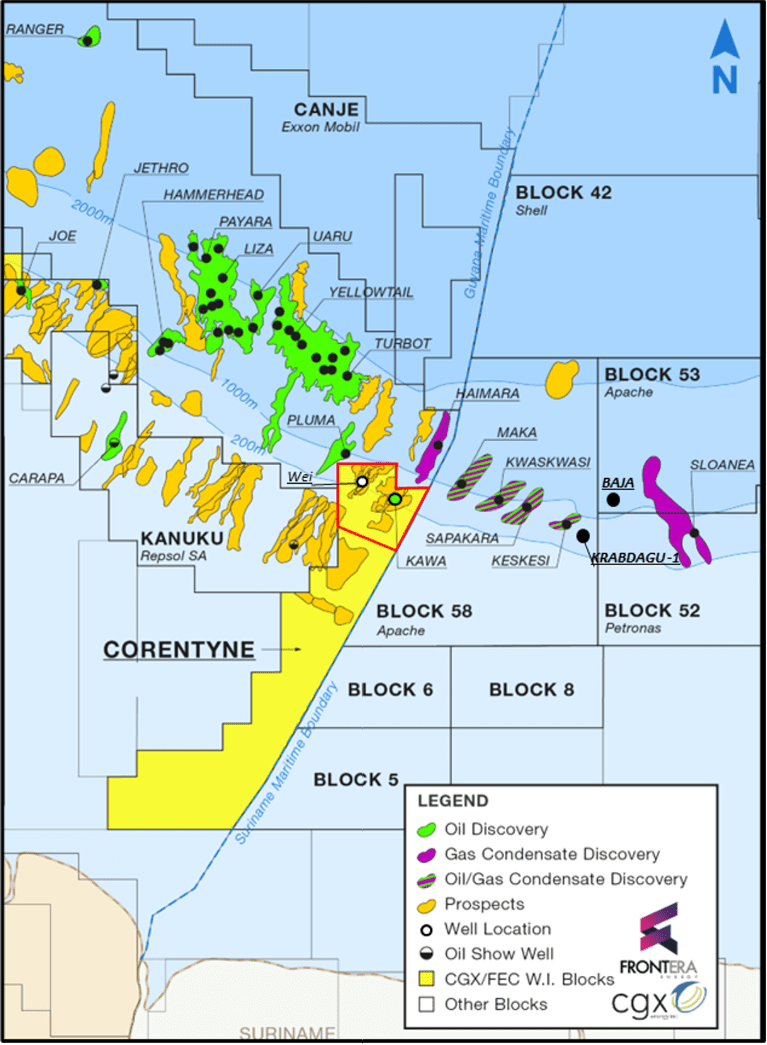

Wei-1 is the second discovery of oil and gas in the Corentyne Block. At the Kawa-1 well, CGX discovered 228 feet (69 meters) of net pay. Both discoveries were made in the northern Corentyne area.

CGX and Frontera have relinquished two blocks to focus exclusively on the potential of the northern Corentyne area.

Minister of Natural Resources, Vickram Bharrat said recently that “it is highly likely that the Corentyne Block can be in production by 2030.”

More exploration/appraisal wells?

CGX said in August financial statements, “Following completion of Wei-1 well and upon detailed analysis of the results, the Joint Venture may consider future wells per its appraisal program to evaluate possible development feasibility in the Kawa-1 discovery area and throughout the northern section of the Corentyne block.”

Bharrat also said “there are plans to do more appraisal wells,” which could mean the long-awaited development may have to wait some more.

CGX has no further drilling obligations beyond the Wei-1 well. Its appraisal program was granted up to June 28, 2024. Its potential decision to drill more could occur during that period.

Financing woes

CGX Energy has been selling off assets to do its Guyana work, and may have to do a lot more of that.

When Frontera first farmed into the Corentyne Block in 2019, it got a 33.33% stake. This has moved to 72.7% on account of multiple transactions with CGX. CGX’s 66.66% in 2019 has dropped to 27.3%. No other license operator offshore Guyana has such a low stake.

CGX has also been selling itself out to Frontera to meet its needs. The more experienced and better capitalized Frontera has been slowly acquiring CGX – and it is primarily by covering CGX’s Corentyne Block expenses that Frontera has been able to do this. Frontera holds 76.05% of the issued and outstanding common shares of CGX on a diluted basis and has the voting power to influence the outcome of all CGX’s corporate transactions.

CGX has said it may seek to secure further financing through a joint venture, property sale or issuance of equity.

In addition to potential future work on the northern Corentyne area, CGX is responsible for construction of the ‘Berbice Deep Water Port’. Having been criticised by Guyana officials for taking too long to complete this project, CGX aims for operation of the base by mid-2024. However, it has said there is no guarantee it will secure the finances to complete the port.