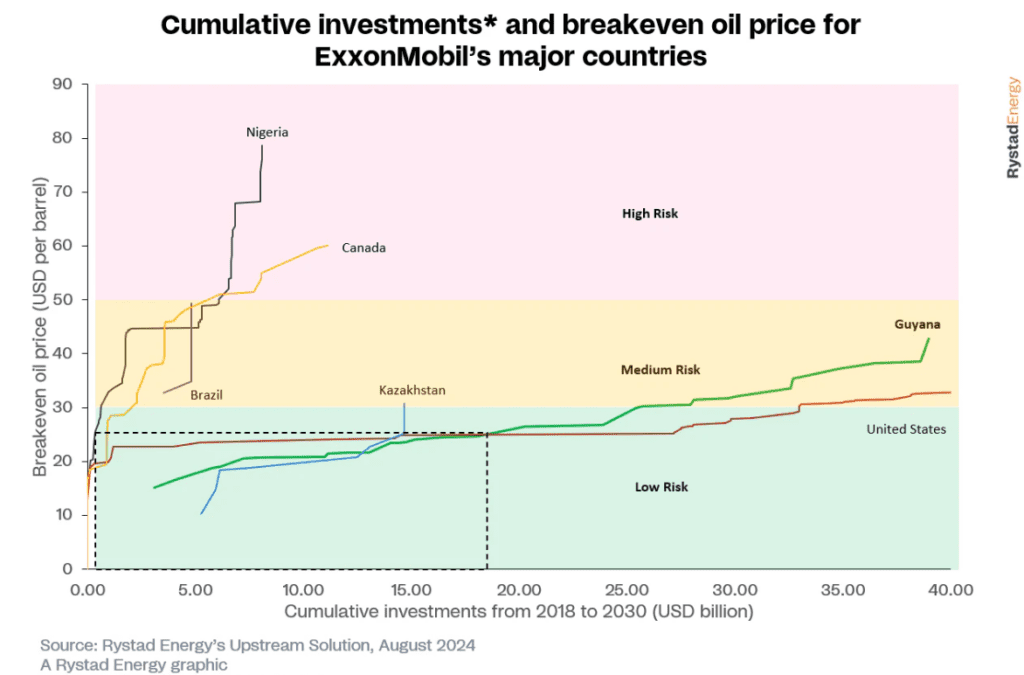

South America’s newest oil producer, Guyana, continues to stand out as a highly competitive destination for deepwater projects around the world. U.S. oil major ExxonMobil is currently spending around 20% of its total exploration and production (E&P) investments in the country and is estimated to exceed $4 billion this year, with projected cumulative investments of about $30 billion by 2030, with excellent investment returns in the medium and long term. This is according to Norway-based business intelligence company, Rystad Energy.

The energy research firm said in a recent analysis seen by OilNOW, that Exxon is expected to invest around $5 billion in its Liza field between 2018 and 2030, with expected free cash flow (FCF) of around $12 billion during the period. This, Rystad Energy said, would mean the company is earning around 2.4 times every US dollar of capital expenditure (capex) spent between 2018 and 2030.

“This exceeds what the major earns per US dollar in the core US shale patches of the Bakken, Permian Midland and Permian Delaware, where the FCF per dollar of capex invested during the same period is 2, 0.74 and 0.5 times, respectively,” Rystad Energy said, noting, “ExxonMobil’s Guyana projects outperform others in the Americas and rank among the best globally.”

The oil major is the operator of the prolific Stabroek Block where over 11.6 billion barrels of oil equivalent resources have been found since 2015.

Rystad Energy said one reason Guyanese projects yield high returns is the extremely low breakeven prices below $30 per barrel, as opposed to U.S. shale, where the average breakeven oil price lies somewhere between $30 and $35 per barrel. The Liza project, where the Destiny and Unity FPSOs have already started production, has a breakeven oil price of $17 per barrel, as opposed to Exxon’s U.S. projects, where a breakeven below $30 per barrel is rare.

According to Rystad Energy, the fiscal regimes in the US and Guyana play an important role. In Guyana’s Stabroek Block, where all the country’s major discoveries have been made, the profit-sharing contract model sees the government take 50% of profit oil. Two percent royalty is applicable on oil production and there is no corporate income tax.

“In the US, royalty oil goes as high as 20% for the projects compared above. Also, unlike Guyana, multiple taxes such as production tax, state corporate tax and federal corporate tax are levied…while corporate income tax can go as high as 21%,” Rystad Energy stated.

Guyanese wells, the energy firm said, have also exhibited excellent estimated ultimate recoveries (EUR), with the Liza field having an average EUR of 57 million boe per well, partly driven by the deepwater discoveries’ excellent reservoir properties and partly by the re-injection of produced gas volumes. New and improved well technology along with strategic placement of wells, also plays a pivotal role.

“Also of note is the way in which ExxonMobil is capitalizing its FPSO costs. The company uses the buy-operate-transfer (BOT) model and leases the FPSOs initially, and after the field starts producing and is making profits, it buys the unit. This spreads out capital costs over a longer duration, making cost recovery more efficient,” Rystad Energy said.

An annual cost recovery of 75% on revenues is applicable in the Stabroek Block. This means companies can offset 75% of their revenues against investments made in the Stabroek Block for that year. So, while ExxonMobil is gaining revenues from Liza’s production, the company can offset a significant part of it by investing in other projects in Stabroek, such as Yellowtail, Whiptail and Uaru. The cost ceiling has been reduced to 65% in the newly awarded blocks.

Rystad Energy said unlike shale fields in the US, where continuous investments are required throughout the field’s life, deepwater Guyanese assets may require substantial financial commitments in the greenfield stage. However, operating expenditures (OPEX) and maintenance capex dominate during the brownfield phase.

Even in terms of internal rates (IRR) of return, Rystad Energy said Guyana stands out as competitive in ExxonMobil’s portfolio. With IRRs as high as 44%, Guyana’s Liza project closely competes with the Permian Midland in the US at 44% IRR and the Permian Delaware at 53% IRR. The higher NPV in US projects is due to higher resources compared to ExxonMobil’s other projects.

“Guyana continues to be an extremely competitive country in ExxonMobil’s portfolio, with a breakeven oil price below $30 per barrel even as cumulative investments rise as high as $25 billion,” Rystad Energy stated. “Almost all the investments expected to be made in Guyana from 2018 to 2030 are considered low to medium risk. Guyana surpasses even the US in profitability with $17 billion to $18 billion of cumulative investments.”

“The ability of Guyana to maintain its cost competitiveness despite an expected drop in future Brent crude prices makes it stand out globally in the upstream sector,” Rystad Energy said. The country’s low breakeven prices, high EURs and its fiscal regime are expected to maintain incoming investments at a high level.

Rystad Energy said the government is trying hard to maintain growth by awarding new blocks and providing attractive investment terms. “However, if Guyana fails to unearth more discoveries of the size of those made on Stabroek and away from that block, it will struggle to sustain the momentum for decades,” the Norway company stated.

Guyana is actively looking to maintain this momentum with authorities recently commissioning a survey to gather data in support of offshore exploration and future bid rounds. The government has also said that it is plugging current incoming oil revenues into development projects that will have long-term positive impact on the economy.