As ExxonMobil positions itself to ramp up production in Guyana’s Stabroek block by adding projects nearly every year, the government plans to spend a majority of its early windfall for development projects.

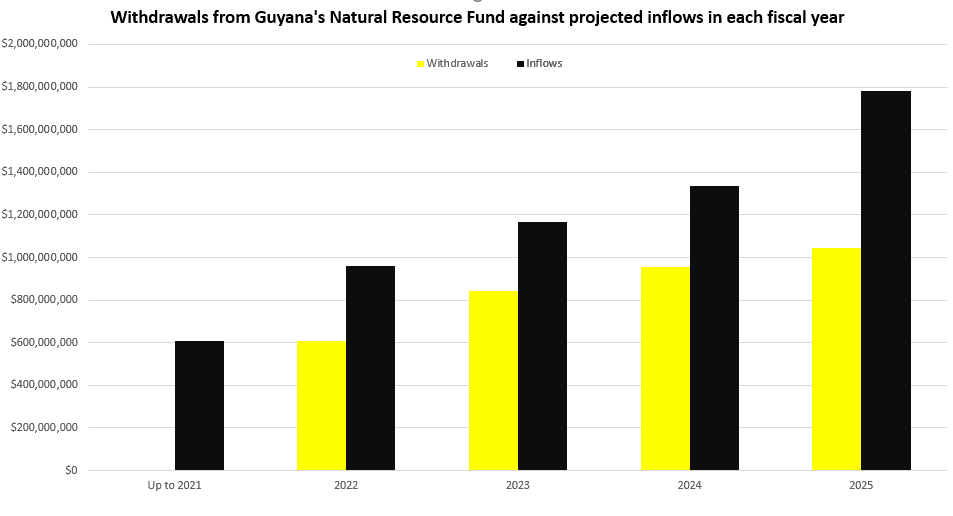

Guyana projects that the total inflows to its Natural Resource Fund, as well as interest and other accruals, will amount to more than US$5.84 billion, in the period from the start of production up to 2025.

Of this, the government projected that its total withdrawals from the Fund will amount to US$3.45 billion in the years 2022-2025.

In the period from the start of production to the end of 2021, the Fund accrued US$607.64 million. The government withdrew all of it to supplement its 2022 budget after Parliament approved it in February.

Upon the passing of the Natural Resource Fund Act 2021 into law in December, a new formula was instituted to calculate a ceiling on annual withdrawals from the Fund, barring an emergency. The rule made one exception that after the law is assented to by the President, there would be no ceiling on the first withdrawal.

For the following years, the ceiling is linked to withdrawals made from the previous year. The government’s projections indicate that for every year up to 2025, it intends to withdraw up to that ceiling.

In 2022, it is projected the Fund will receive US$957.87 million, including inflows and interest. From this lot, about US$843.21 million would be withdrawn for the 2023 budget cycle.

In 2023, it is projected the Fund will receive US$1.16 billion. US$957.57 million would be withdrawn for the 2024 budget cycle.

In 2024, it is projected the Fund will receive US$1.33 billion. US$1.04 billion would be withdrawn for the 2025 budget cycle.

Finally, in 2025, it is projected the Fund will receive US$1.78 billion.

By the end of that year, about US$2.39 billion would remain in the Fund.

When the formula used to calculate the ceiling was made public, it had immediately received criticism from local commentators.

In a January column in the local Stabroek News, Chartered Accountant and Attorney-at-Law, Christopher Ram, criticised the allowances as too sizeable. He said, for example, “The formula used in the current Act allows for the automatic withdrawal of $1,250 million, or 62.5%, of the first US$2 billion earned in any year.”

This is a striking sum for Guyana, when one considers that it amounts to almost half of its 2022 budget. Ram warned that huge injections of foreign currency into a small economy can have significant consequences.

On the other hand, Co-Director of Americas Market Intelligence Energy Practice, Arthur Deakin, said that using most of Guyana’s oil wealth for economic development in its early years is good for the country. He said that the practice – called frontloading – is needed to establish the foundation for Guyana’s future development, by building up local capacities, infrastructure, education and healthcare.

The Ministry of Finance, in defense of the planned withdrawals, said that Guyana has development needs that should be urgently addressed. The government has made it clear that it intends to utilize a sizeable amount of oil revenues now in order to tackle poverty and improve the standard of living for Guyanese.