The rapid increase in oil production offshore Guyana will perhaps be coming at one of the most opportune times in the boom-and-bust cycle of the industry as more experts agree that a major supply crunch is on its way and non-OPEC barrels will have to help fill the gap.

“Underinvestment in oil supply will lead to a tight oil market later this decade. It’s a narrative that’s gained increasing traction as capital expenditure on upstream oil and gas has shrunk,” says Simon Flowers, Chairman, Chief Analyst and author of The Edge at consultancy group Wood Mackenzie.

Spend in 2021 is half the peak of 2014 after slumping to new depths in last year’s crisis, Flowers said. In his latest article in The Edge, the Chief Analyst said he asked Harry Paton of WoodMac’s Oil Supply team and Ann Louise Hittle, Head of Macro Oils, how they see the medium-term market fundamentals developing and the implications for price.

They believe about 20 million b/d from 2022 to 2030 will be needed, signaling the world will be in need of significant volumes to fill this gap.

“This is the ‘supply gap’, the difference between our estimate of demand in 2030 and the volumes we forecast existing fields already onstream or under development can deliver,” Paton and Hittle said. “Fleshing that out, we expect oil demand to grow from 2022 to 2030, rising by just under 7 million b/d. The rate of growth, though, slows through the period to less than 0.5 million b/d a year by 2030.”

The experts said non-OPEC onstream supply will fall by 13 million b/d over the same period. This is mainly a function of the natural decline of mature assets in big producing countries including the US, China, Russia and Norway.

Nevertheless, Paton and Hittle said the U.S. and other sources will help fill the coming supply gap which will include yet-to-find wells and other volumes.

In Guyana, Stabroek block operator ExxonMobil and co-venturers, Hess and CNOOC, have already found more than 9 billion barrels of oil equivalent resources and multiple prospects remain on the 6.6 million acres license.

U.S. Geological Survey may have grossly underestimated massive Guyana-Suriname basin potential

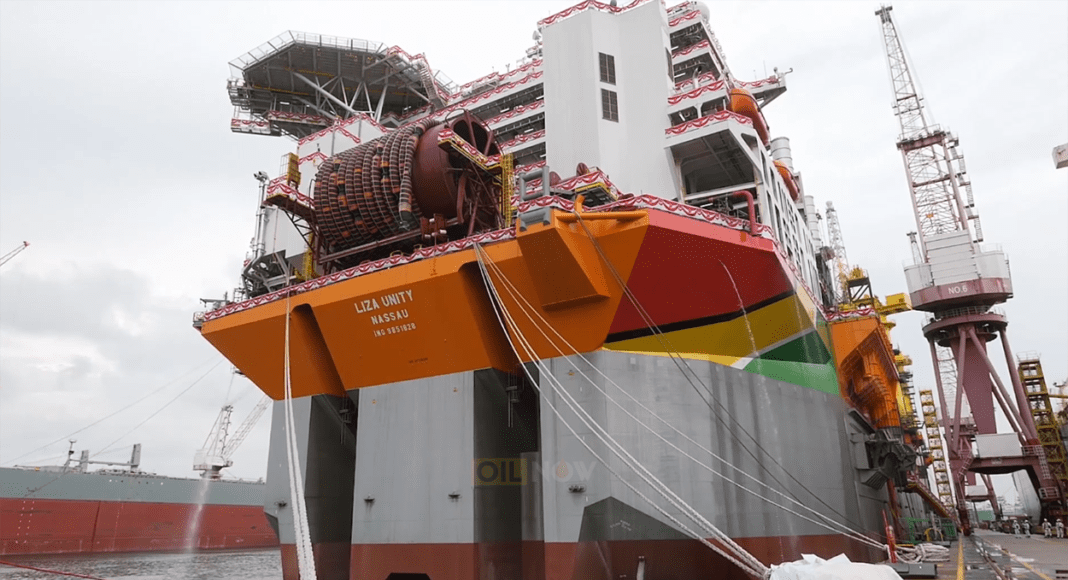

Output is set to increase from the current 120,000 bpd average at the Liza Phase 1 Development to over 1 million barrels per day by 2025 from multiple projects at the giant Stabroek block. Officials at Hess say a combination of these projects and output optimization on the FPSOs will see production increasing significantly.

A two-week shutdown is planned at Liza Phase 1 in November which will facilitate the installation of a new flash gas compressor on the FPSO along with the debottlenecking of some piping. Following this exercise, the vessel’s nameplate will rise to between 140,000 to 150,000 barrels a day.

Greg Hill, Chief Operating Officer (COO) at Hess said he anticipates that FPSOs operating offshore Guyana would be similarly optimized. “And when you helicopter down, you can say five ships by 2025 producing in excess of one million barrels.”

Coming oil price bounce, supply shortfall opening space for Guyana barrels

WoodMac has said that Guyana’s giant oil fields will deliver untold riches to the nation of just over 750,000 people making the new oil producer the king of the heap.

“Production per capita will eclipse even that of the leading Middle East producers, Kuwait, UAE and Saudi Arabia,” the U.K based consultancy group said, making Guyana just the 11th nation in history to cross the 1 million bpd milestone.