President of Guyana Dr. Mohamed Irfaan Ali and Vice President Dr. Bharrat Jagdeo say the government is pleased with the interest shown in the country’s first offshore licensing round, despite receiving bids for only eight out of the 14 blocks offered.

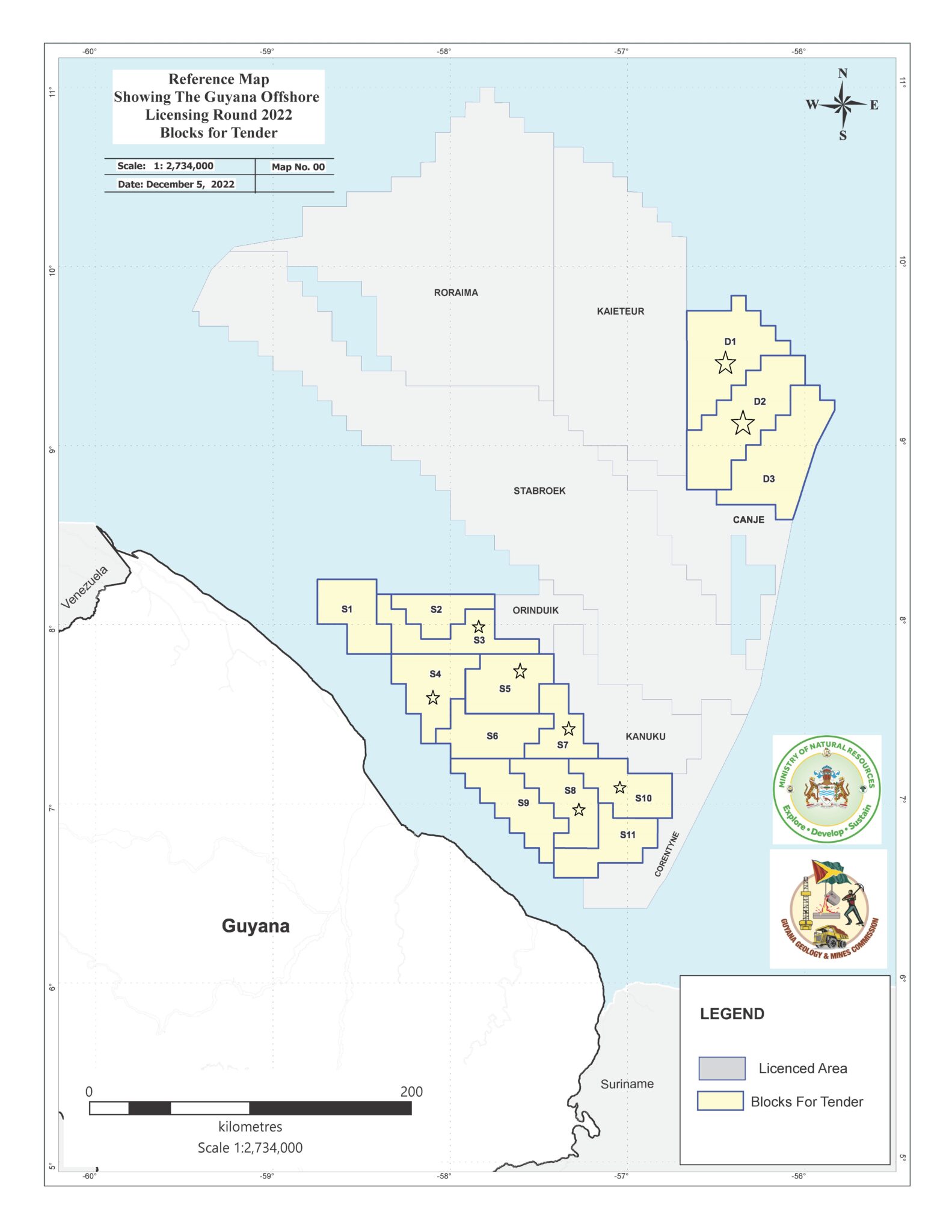

The bid round attracted 14 offers from six bidders, including major players like ExxonMobil and TotalEnergies, who already have interests in Guyana’s offshore oil sector. However, it is noteworthy that six of the 14 blocks (D3, S1, S2, S6, S9, and S11) did not receive any bids.

President Irfaan Ali said during a recent Washington DC-based Inter-American Dialogue (IAD) forum: “It is not a disappointment at all. In this market [and] let us be very open and factual about this. We went out and auction[ed] at a time when major economies in the world were basically saying to oil producers, ‘We’re not going to finance you.’ So, you’re going to a market where raising of capital is an issue.’”

The Head of State said the fact that eight out of 14 blocks received bids is significant, as many countries are putting blocks on offer, but getting little to no interest.

“A number of people are questioning whether this was a successful bid round,” Jagdeo stated. “We are extremely pleased with how the round has gone.”

He stressed that the government put a great deal of effort into modernising the regulatory framework for the oil sector, including new contracts that would secure a greater government take.

“We had said that any future block would be given out only through a bidding process. We also said we would not complete the bid round unless there is a new framework,” Dr. Jagdeo said.

Under this new framework, he explained that Guyana has implemented several significant changes to the terms for oil exploration and production. The reforms include imposing a 10% royalty, income tax, capping cost recovery at 65%, increasing funding for training and safety requirements, and requiring more timely data submissions for enhanced government monitoring of offshore activities. The Petroleum Activities Act also introduced a signing bonus requirement, a work plan requirement, and penalties for failure to meet the work plan’s objectives.

Furthermore, the Vice President highlighted the competitive landscape in the global oil industry. He noted that other countries are vying for investments from oil companies and are willing to lower government stakes to attract these investments. In this context, Dr. Jagdeo suggested that these countries use their fiscal regimes to outcompete each other.

He said that if the old disposition (law and contracts) remained, he believes all 14 blocks would have been taken up, as they were less stringent and allowed for a higher company take. He argued that with the new framework, companies are encouraged to utilise efficiently the assets they acquire, rather than holding them without productive use.

Government had placed 11 shallow water blocks on auction, and three in deep water. Evaluation of bids is scheduled to occur from September 18 to October 6, 2023. Jagdeo opted not to identify the blocks each bidder submitted bid(s) for, arguing that he prefers to wait until the evaluation has concluded. The government aims to award contracts by November 1.

The bidders are:

1. TotalEnergies, Qatar Energy, and Petronas

2. Delcorp Inc., Watad Energy and Arabian Drillers

3. ExxonMobil, Hess, and CNOOC

4. Liberty Petroleum Corporation and Cybele Energy

5. Sispro Inc.

6. International Group Investment Inc. and Montego Energy