Oil and gas investments in Guyana remain attractive even with the fiscal terms in its new model Production Sharing Agreement (PSA) which are more favourable to the country. This is according to an August 10 report by S&P Global Commodity Insights.

The fiscal terms are a stark contrast to the widely debated Stabroek Block deal. The new terms do not apply to this agreement.

They were introduced on March 14 for Guyana’s first licensing round.

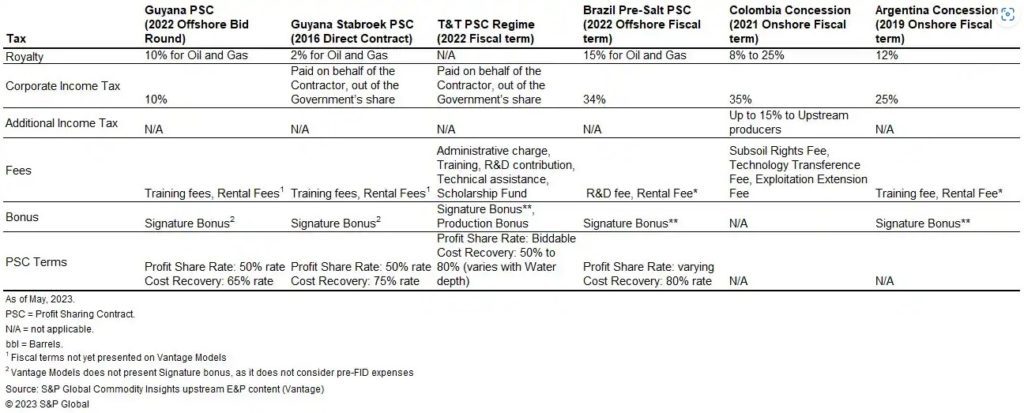

S&P pointed out that the in-draft fiscal regime contains aspects similar to PSAs in Latin America – mainly the corporate income tax and higher royalty rates. Future developments offshore Guyana will carry a royalty rate of 10%; the Stabroek Block’s PSA has 2%. The corporate tax stands at 10%. Guyana also said the 75% cost recovery ceiling has been lowered to 65%. The sharing of profits after cost recovery will remain 50/50 between the government and the contractor.

“Overall, Guyana managed to maintain its attractiveness in the region compared to other Profit Sharing Contracts (PSC) although now it is slightly less attractive compared to the Trinidad and Tobago PSC,” S&P said in its report.

The report noted that though Guyana’s new terms are “less attractive” than the Stabroek PSA, it does not include additional income taxes like those introduced in Colombia, or new fees.

Arthur Deakin, Director of Energy Practice at Americas Market Intelligence (AMI) made a similar point. He foresees the licensing round garnering “significant interest” even with the new terms, as there were fears that the proposed fiscal regime would turn away investors.

And interest remains high.

The Guyana government had reported that all of the 14 blocks received expressions of interest from majors like Shell, bp, Petrobras and others.

The prospects range from 1,000-3,000 square kilometres (sq. km) in size. Of those blocks, 11 will be in the shallow area, mainly from what was known as the Oreo area, and the Demerara block, which was relinquished by CGX Energy and Frontera Energy. The remaining three blocks will be in the deep area C at the northeast border with Suriname. A total of 25 billion potential barrels are at stake.

Guyana has set a new deadline of September 12 for the submission of bids. It will evaluate bids between September 12 and October 6, and commence negotiations from October 10 to 27. November 1 has been set for the award of contracts.

Get more information on the upcoming bid round here: Guyana Licensing Round 2022 – Ministry of Natural Resources | OilNOW