By Dr H. Arlington Chesney – OilNOW

Recent global activities have re-emphasised the importance of oil and gas revenues emanating in the Caribbean with the achievement of climate resilient activities and acceptable food security levels in the Caribbean Community and Common Market (CARICOM). Recent global activities have also re-emphasised the exceedingly important relationship between regionally obtained oil and gas revenues and acceptable levels of food security in CARICOM. Indeed, the linkage between these two parameters is now existential. Supporting this reality is the contributory role of regional oil and gas to European energy security at least in the short term.

On October 27, 2022, the World Bank Food Security Update stated (i) Food commodity prices declined from their all-time highs in April. However, grain supplies will be lower due to lower yields (weather related) in the USA and European Union, (ii) Fertiliser prices could remain historically high because of upside risks, (iii) The Black Sea Grain Initiative (BSGI) increased grain availability and reduced food prices since April. However, further supply disruptions are possible if the BSGI is not renewed, and extreme weather, driven by climate change, puts pressure on food production and prices.

In December, Purdue University/CME Ag Economy reported that rising interest rates and high input and energy costs are creating uncertainty amongst US farmers with 80% responding that it was a “bad time” for investments.

On November 20, an extended COP27 concluded in Egypt. A major achievement of small island and low-lying developing states (SIDS), like CARICOM, was the eventual acceptance by developed nations to create a Fund to pay for Loss and Damage caused by climate change. However, details, such as, “who shall pay into the Fund, where the money will come from, and which countries will benefit” have not been agreed. Recommendations will be made to COP28 in November/December 2023.

There were also no specific commitments from developed countries to meet the US$100 billion shortfall in funds promised for developing countries to implement adaptation measures required to minimise climate change effects.

“On COP27’s heels”, USA promised support to climate resilience and sustainable development in SIDS through a Local2030 Islands Network and expanding access to risk-based insurance for most vulnerable countries. This may benefit CARICOM countries.

Notwithstanding and important for CARICOM’s oil-producing countries, fossil fuel use was not rejected.

The results on immediate development funding at COP27 will disappoint CARICOM Heads who have identified development/debt financing as a priority for sustainable development. This is further magnified, as in November 2022, (i) FAO’s Food and Agriculture Sustainable Development Initiative called for quantitative and qualitative improvement in Climate Change funding, and (ii) the United Nations Development Programme’s Adaptation Gap Report, subtitled “Too little, too slow”, stated that US$160-340 billion annually will be required by 2030 for the 152 developing countries to implement a meaningful climate change adaptation programme, “concentrated in agriculture, water, ecosystems and cross-cutting sectors”. Extrapolating, CARICOM’s requirements will approximate US$21-45 billion annually.

Another instructive event is the Russia/Ukraine war with Russia menacingly threatening its oil and gas supply to the EU: supplying in 2021, 40 and 34% respectively. Although the situation appears very dynamic, the EU, to (a) minimise or remove future threats, could from early 2023 cease purchasing Russian supplies, and/or (b) damage Russia’s economy, cap its purchase price at US$60/barrel.

A very likely outcome is the EU immediately requiring alternative supply sources. CARICOM, as a traditional geopolitical ally, can be a preferred option. Indeed, Guyana and Trinidad and Tobago have in 2022, on a year-to-date basis, increased their exports of oil and gas (LNG), respectively, to Europe.

Simultaneously, even with a very dynamic market, the prices for oil and natural gas are projected to remain relatively high in 2023 although not at the “heady heights” of $139/barrel in March 2022. The regional oil and natural gas suppliers, especially Guyana, are expected to accumulate healthy revenues in 2023/24.

In September 2022, the Visual Capitalist opined that (a) high energy prices could increase food insecurity and social unrest and (b) utilising World Bank data, high energy prices influence up to 64% of food price movements.

The major conclusions and/or actionable items from these recent and instructive happenings are: CARICOM, with its small market, can’t depend on the EU and/or the USA, for adequate and reliable supplies of grains, its second most important food import group. CARICOM, with estimated additional annual needs of US$21-45 billion, can’t immediately expect significant increased financial support from previous and newly identified funds to address its critical climate change issues that impact negatively on food security. CARICOM oil and gas producing states are well positioned to be preferred oil and gas suppliers to the EU, gaining substantial revenues as global prices are forecast to remain elevated in 2023/24.

CARICOM with projected high energy prices could experience high food prices and possibly social unrest.

Ultimately, CARICOM will have, in the short term, inadequate amounts of international finance to implement needed activities to address climate change and food security issues. With respect to the latter, this opinion concentrates on grain.

This reality places great responsibility on the oil and gas producing countries, with their substantial windfalls, to ensure that CARICOM, collectively, achieves acceptable levels of food security and implements minimally required climate change adaptation measures. Guyana’s Finance Minister, Ashni Singh, recognised this responsibility stating on November 29 that “Guyana intends to utilise its oil revenues to lay a path towards agriculture, transport infrastructure and other areas”. Guyana, in its continuing regional leadership for agriculture, must expand this outlook regionally. A paradigm recently exhorted by Prime Minister Mia Mottley as “necessary to uplift Caribbean people”.

The Guyanese leadership must (a) appreciate that the region is insecure if any member state remains with a food deficit: a distinct possibility without access to significant quantities of external development funds, (b) recognise that regionally obtained oil and gas revenues are now existential to achieve the 25×2025 Initiative, and (c) include Suriname and Trinidad and Tobago to partially utilise regional large oil windfalls directly and/or indirectly to assist other countries to achieve acceptable levels of food security.

A geographical and organisational approach is recommended for the use of such funding to replace regional imports of soybeans, corn, and rice, with approximate annual (2015-2022) values of US$73 million, US$65 million and US$22 million, respectively.

Geographically, it’s recommended that Guyana accelerates its production of soybeans in the intermediate savannahs. Suriname, with similar soil types and topographies, using lessons learned in Guyana can initiate production in two/three years.

Similarly, corn production can be rapidly expanded in Belize, taking advantage of decades of successful cultivation by Belizean farmers, particularly the Mennonites. Unlike Guyana, which is already drastically expanding and improving port facilities to enable oil services, Belizean facilities will most likely require modernisation and upgrading to enable intra-regional trade.

Further, Guyana and Suriname have traditionally successfully produced rice commercially. These acreages, along with supporting infrastructure throughout the value chain, could be expanded rapidly. For Guyana, abandoned sugar lands, with existing basic drainage and irrigation infrastructure, are available for this expansion.

With the proposed expansion, appropriate quantities of quality seeds of suitable, ecologically adapted and high-yielding varieties, must be produced, preferably regionally. For rice, Guyana has traditionally produced both breeders and commercial seed.

For soybean and corn, commercial seed can be produced in Antigua and Barbuda, Belize and Trinidad and Tobago, which have technical and environmental advantages and/or experience. The Caribbean Agricultural Research and Development Institute (CARDI) can coordinate this production.

Based on recent global events, food insecurity along with food and energy prices may remain high for CARICOM at least for 2023/24. With energy cost influencing 64% of food price movements, the realisation of the existential relationship between regional oil and gas windfalls and its food security levels is now easily understood.

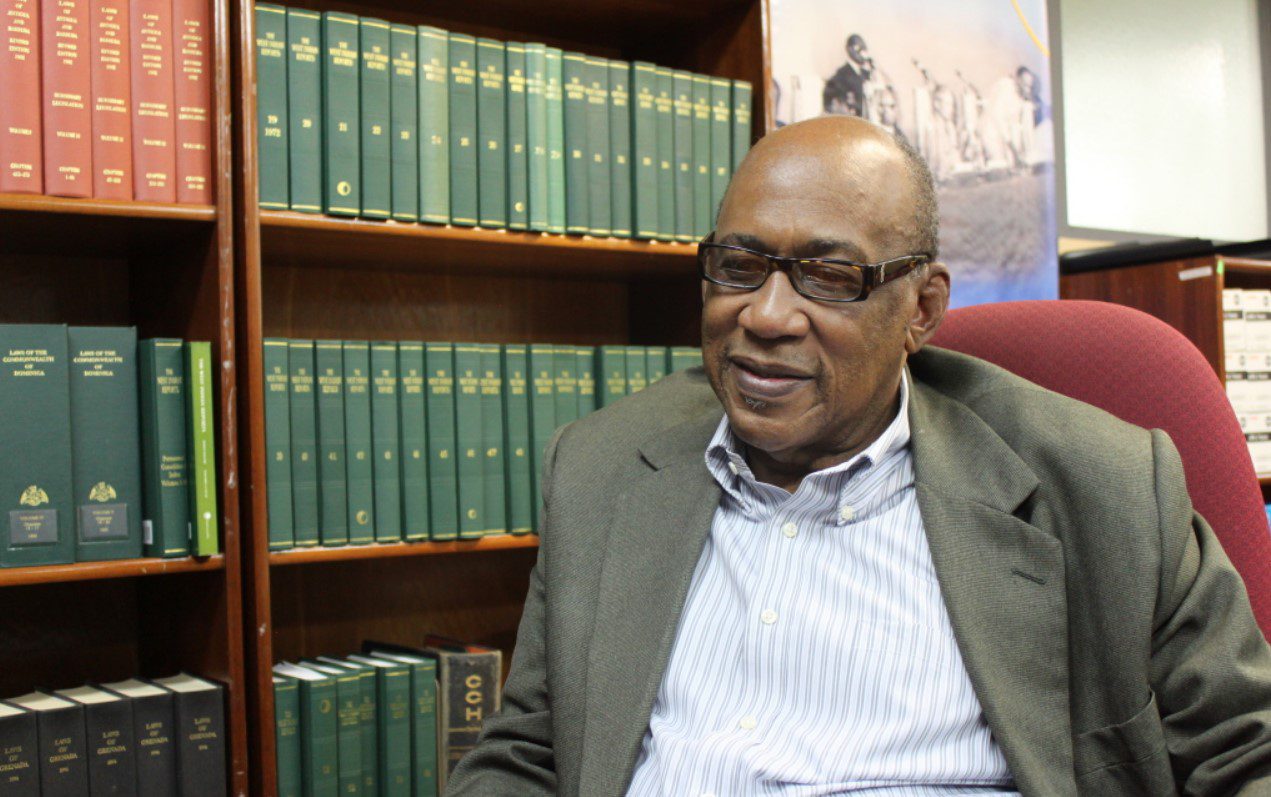

About the Author

Dr. H. Arlington Chesney is a leading Caribbean Agricultural professional who has served his country, the Caribbean and the hemisphere. He is a Professional Emeritus of IICA and in 2011, was awarded Guyana’s Golden Arrow of Achievement for his contribution to agricultural development in Guyana and the Caribbean.