US-based private financial and investment company, The Motley Fool, says ExxonMobil’s fifth development project off the coast of Guyana is a clear indication of the major’s confidence in the oil market.

The Uaru development, set to deliver first oil in 2027, is expected to cost around 27% more than the last Guyana project.

“It’s a massive undertaking for the company (Exxon) and its partners, Hess and CNOOC, representing a bold bet on the oil market’s future,” The Motley Fool said in an analysis by Matthew DiLallo, published on January 18.

The project, which will produce at a steady rate for two decades, is now estimated to cost US$12.683 billion (GY$2.638 trillion).

ExxonMobil adds third reservoir target to massive Uaru development

The oil major and its partners have already committed to invest $30 billion to build the first four Guyana projects. Exxon is the operator and is funding 45% of the capital investment. Hess holds a 30% stake, and CNNOC is a 25% partner. The fifth project would increase their Guyana production capacity to 1.2 million bpd by 2027.

“That puts them on pace to triple their output from last year’s total within the next few years,” The Motley Fool stated.

Guyana has been a game-changer for Exxon and Hess. The companies made their first offshore discovery at the Stabroek Block in 2015 and started producing in 2019. Exxon has made more than 30 discoveries, uncovering an estimated 11 billion barrels of oil equivalent. Guyana believes there’s more crude underneath its waters and estimates its resources to be as much as 25 billion barrels. It’s planning to auction off more acreage licenses to entice other companies to explore off its shores.

Dutch company to supply 24 jumpers for US$12 billion Uaru Project

“ExxonMobil’s strategy to continue investing in oil and natural gas projects has paid big dividends over the past year,” The Motley Fool said. “It has capitalized on its growing production from low-cost regions like Guyana to cash in on higher prices, and set a quarterly profit record of $19.7 billion in Q3.”

Uaru will be the largest ever project to date, offshore Guyana, by cost and volume of resources to be produced.

Guyana could export gas from the upcoming Uaru project, but there’s a catch

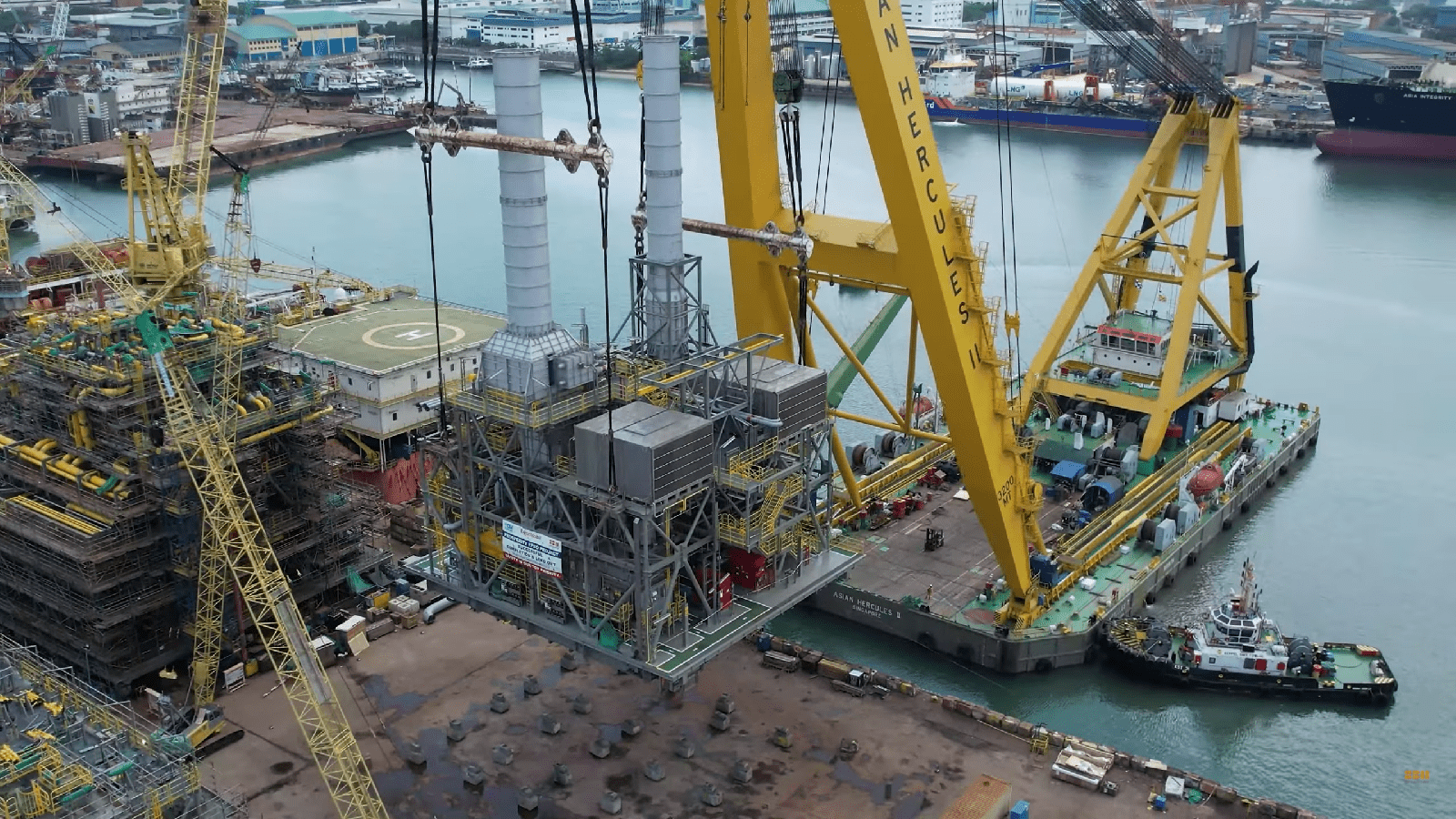

The project scope includes drilling approximately 38-63 development wells, installation and operation of subsea umbilicals, risers, and flowlines (SURF) equipment; installation and operation of a floating production, storage, and offloading (FPSO) vessel; and ultimately, project decommissioning.