Frontera Energy Corporation has disclosed that it loaned its joint venture partner, CGX Energy Inc., US$19 million so that it would be able to cover its share of the costs related to the Corentyne, Demerara, and Berbice blocks; the Berbice Deepwater Port; and other budgeted expenses.

Chief Executive Officer (CEO) of Frontera, Orlando Cabrales was keen to note that the loan agreement with CGX is an important step forward in moving ahead with the development of its world-class assets in Guyana while adding that the joint venture partners are on track for spudding the Kawa-1 well in the second half of 2021. This well is expected to be drilled in the Corentyne Block in a water depth of approximately 1,100 feet targeting the Santonian.

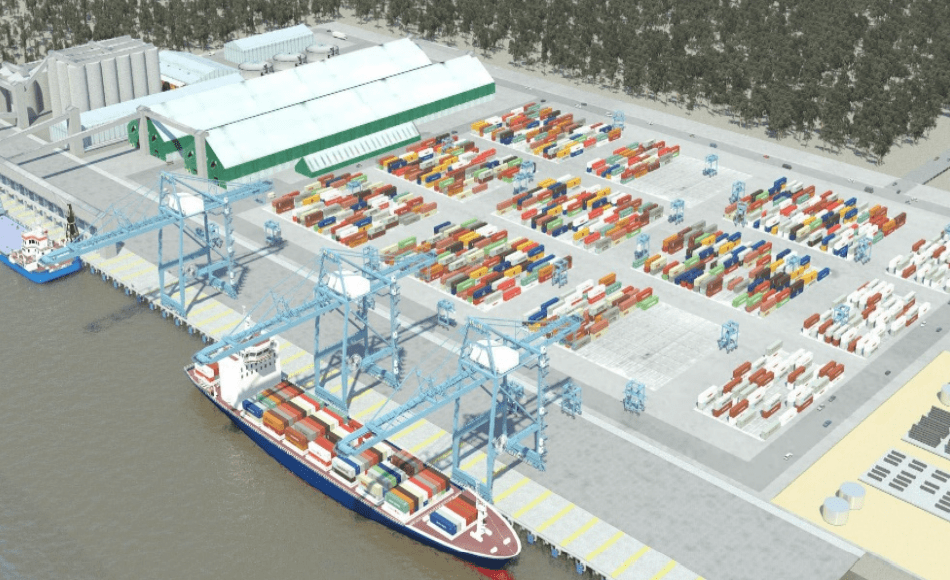

In support of his colleague’s position, Professor Suresh Narine, Executive Co-Chairman of CGX noted that the partners are developing the infrastructure necessary to support and enhance broader energy and trade industry activity through the Berbice Deepwater Port Project which is expected to cost US$130M. The project targets full operation of the oil and gas support base in early 2022 and the cargo terminal in 2023.

Regarding the loan agreement, Frontera noted that it will be available for CGX to drawdown in tranches on a non-revolving basis until October 2021, or the date on which CGX (or its subsidiaries) enters into a binding transaction that provides funds to repay the amounts outstanding under the loan.

OilNOW understands that the loan together with all interest accrued shall be due and payable on June 30, 2022, or such later date as determined by Frontera, at its sole discretion. Interest payable on the principal amount outstanding will accrue at a rate of 9.7% per annum payable monthly in cash, with interest on overdue interest.

If the loan is extended by Frontera past June 30, 2022, at its sole discretion, the new interest rate will be 15% per annum. Also, the loan will be secured by all the assets of CGX.

The Loan agreement also includes a standby fee of 2 percent multiplied by the daily average amount of unused commitment under the Loan payable quarterly in arrears by CGX during the drawdown period.