Head of Guyana’s Gas to Power Generation Taskforce, Winston Brassington, revealed on Monday that the current estimates for the project which is expected to deliver affordable power to the nation of just over 750,000 people should cost approximately US$900M.

During a presentation at the Arthur Chung Convention Centre on the initiative, he disclosed that the offshore pipeline and riser are projected to cost US$570M to US$630M while the onshore pipeline will run between US$80M and US$100M. As for the onshore plants for Natural Gas Liquids (NGLs), this is estimated to cost US$120M while the onshore infrastructure is pegged at US$40M to US$50M. Overall, the projected cost stands in the vicinity of US$810M to US$900M.

Brassington, who was accompanied by Vice President, Dr. Bharrat Jagdeo and other key officials working on the Task Force said these are the limits on cost as provided to the government by ExxonMobil. The Vice President also stressed that the objective of the team is to ensure costs are reduced as much as possible but stressed that it would not jump beyond the US$900M mark.

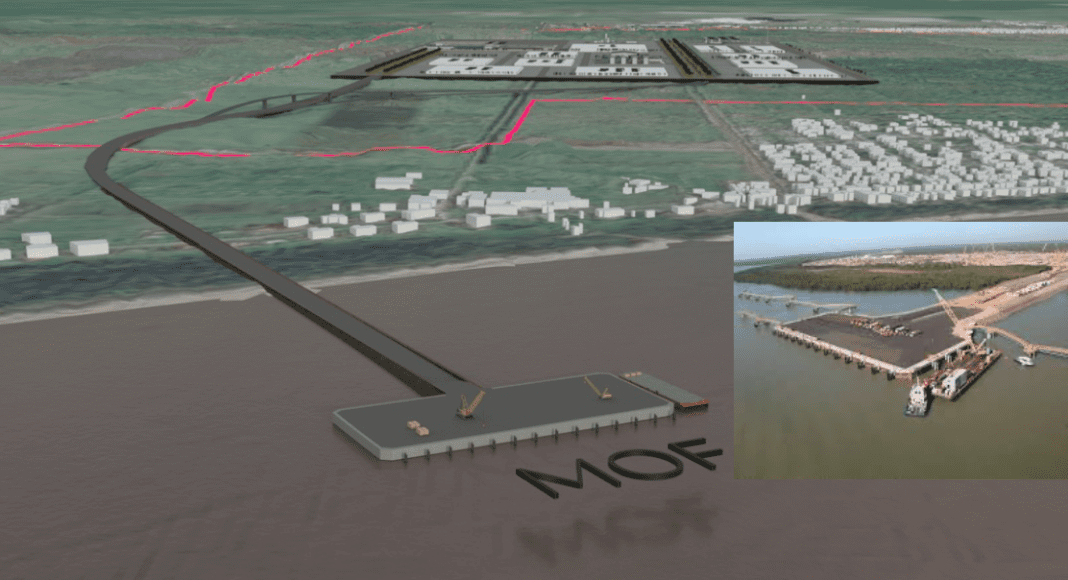

Regarding funding for the pipeline which will pass through Crane and other communities before being landed at Wales on the West Bank of Demerara, Brassington said it was agreed that it would be taken from cost oil by ExxonMobil.

OilNOW understands that the country is expected to clear off the estimated cost for the offshore pipeline and riser within a four-year period.

Further to this, Brassington said a commitment was given to the government by ExxonMobil, that it would make available, 50 million cubic feet of gas per day which would be enough to provide 250 megawatts of power from the proposed 300-megawatt plant to be built onshore.

While independent studies are expected to be completed in 18-months to ensure that the project is properly executed, Brassington was keen to note that several studies which were conducted pre-2020 do point to the economic feasibility of the project.

The studies he referenced include: Gas to Power Feasibility Assessment in Guyana by K&M Advisors; Oil and Gas Master plan by Japan Cooperation Centre Petroleum Chiyoda Corporation; A Study on System Expansion of the Generation System by Brugman SAS; Desk Study of the Options, Cost, Economics, Impacts, and Key Considerations of Transporting and Utilizing Natural Gas from Offshore Guyana for the Generation of Electricity (2017) by Energy Narrative; Feasibility Study for Guyana’s Offshore Natural Gas Pipeline, NGL Separation and LPG Production plant, and related electricity infrastructure – 2018 by Energy Narrative; and a Feasibility Study for Guyana’s Offshore Natural Gas Pipeline, NGL Separation and LPG Production plant, and related electricity infrastructure – Revised Final Report: Appendix C by Energy Narrative. These studies were all released to reporters on Monday.

As for the selection of Wales, Brassington said, “This was an area that was studied extensively for many years. Over 20 different locations were identified and as many criteria to select the location. By the time we came to the table last year with Exxon, Exxon had narrowed the location down to Ogle and the West Coast. After reviewing this further, the decision was taken for the location to be Wales.”

He added, “Now, this location was guided by a number of considerations; the low risk of flooding, relatively low cost of land, the suitability for the plant development, and the location being away from population centres etc.”

Once all of the engineering and independent studies have been completed, he said it will all go to tender, and the final cost would be provided.

With this project, it is the government’s hope that gas from the offshore Liza field will pave the way for the country to benefit from power generation at a rate of around three US cents per kilowatt-hour. It is expected to drop even further once the pipeline is repaid in four years’ time and even allow for annual cost savings totalling US$150M.