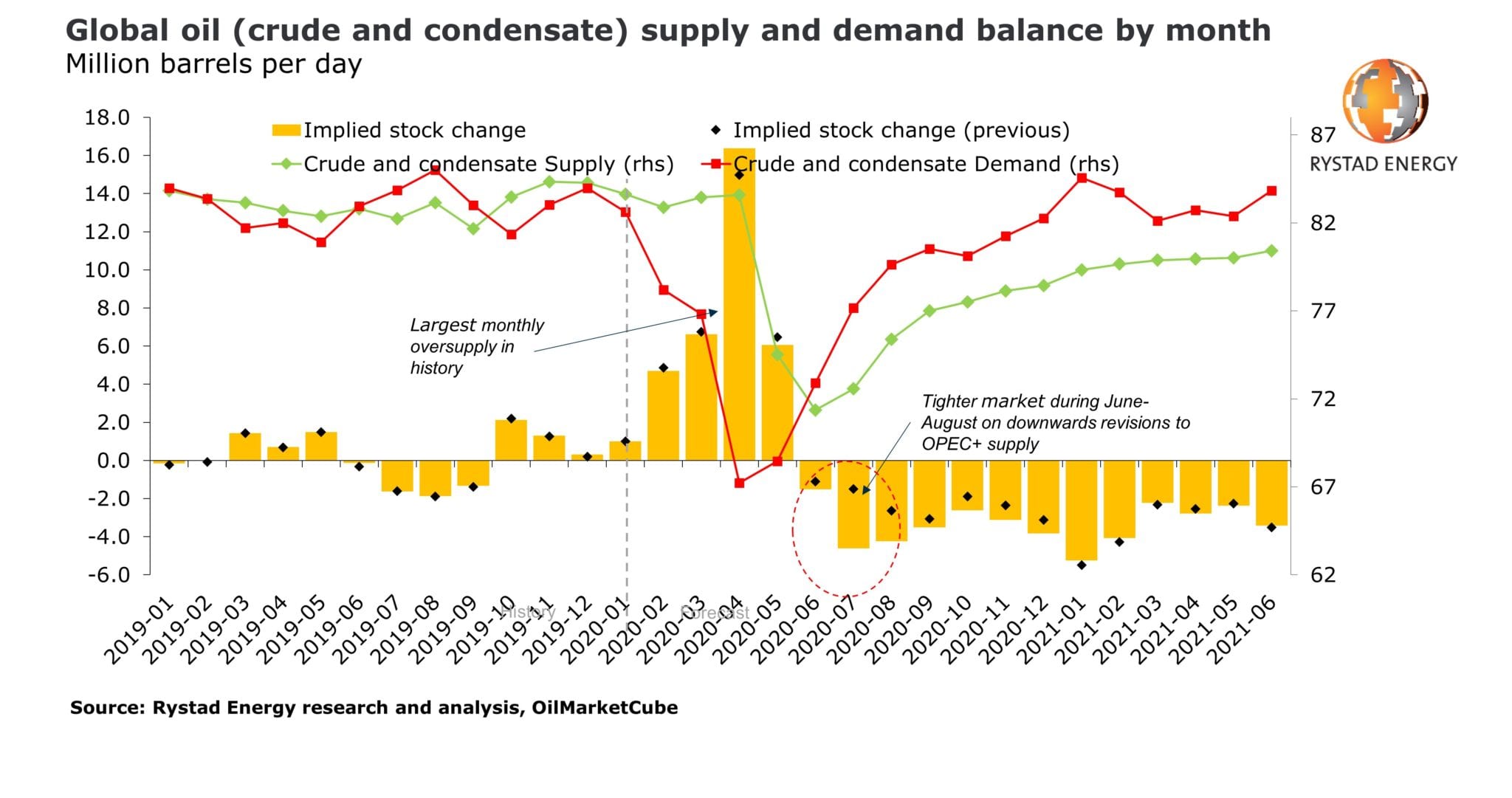

The forced oil production shutdowns and the extension of the generous OPEC+ voluntary cuts into July will not only balance the Covid-19-hit global crude and condensate demand, but are deep enough to create a monthly deficit starting from June 2020 and continuing uninterrupted until at least the end of next year, a Rystad Energy analysis shows.

The oversupply, which sent WTI oil prices into the negative earlier this year, is a thing of the past as long as OPEC+ compliance stays strong and the oil demand recovery trajectory isn’t radically altered. The last surplus month appears to have been May when crude and condensate production exceeded demand by about 6.1 million barrels per day (bpd).

June is now already set for a global production deficit of about 1.5 million bpd. The imbalance is forecast to reach 4.6 million bpd in July, 4.2 million bpd in August and, after being reduced a little during the remainder of 2020, peak at 5.2 million bpd in January 2021. Although the shortfall will ease after that, Rystad Energy estimates that monthly deficits will remain throughout next year.

“We believe OPEC+ is attempting to create a mini-bull-cycle by quickly tightening the prompt market, helping depressed prices and creating a supply environment that will facilitate a rapid relief of oil storages, as deficits will trigger large stock draws,“ says Rystad Energy’s Head of Oil Markets Bjørnar Tonhaugen.

Rystad Energy estimates that global crude and condensate production will stay below 80 million bpd for all the remaining months of 2020. Output will likely reach 71.4 million bpd in June and grow monthly to a high of 78.4 million bpd in December.

Demand, on the other hand, is set to reach 72.9 million bpd already in June 2020 and exceed 80 million bpd from September onwards, reaching an annual monthly high of 82.3 million bpd in December.

“However, if the oil price continues its steady ascension, this will spur reactivation of parts of the curtailed US oil production. Also, if frac crews end their holidays early, US volumes may be coming back more quickly than OPEC+ expects, bridging part of the deficit,” adds Tonhaugen.