Hugo De Stoop, CEO of Euronav says the oil tanker market is likely to continue to improve despite renewed concerns over coronavirus threats, but a further recovery in freight rates is needed before the sector returns to good health.

In a report on Monday, S&P Global Platts quoted De Stoop as saying that Concerns about the coronavirus may weigh on the extent to which demand for oil tankers will grow but there are no immediate prospects of a demand decrease or forced consolidation in the sector.

The market has started emerging from the trough it languished in over the summer and rates are improving, but they need to recover further for the sector to become profitable again, he told S&P Global Platts.

Tanker operators are well placed to wait for the market to recover following a bumper year in 2020, De Stoop said. Platts assessed the USGC-China VLCC rate at a record of $69.814/mt March 30, as a slump in the oil market prompted a rush for storage.

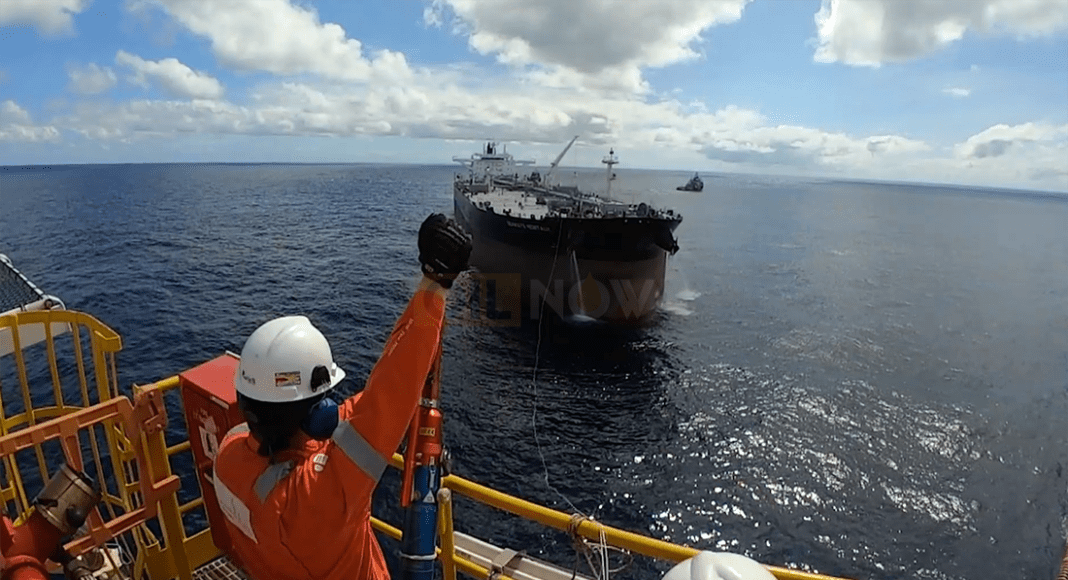

Predicting growth areas is hard but the Atlantic basin continues to show promise, De Stoop said: “[It] continues to be a place where the type of oil and the distance over which it needs to be transported is very favorable for the tanker market.”

Caribbean voyages at significant time advantage for tanker owners, Platts says in new report

Brazil has continued to increase its production year on year and has development plans until 2026 and significant reserves in Guyana are also promising, he said.

ExxonMobil, the operating partner of a consortium with Hess and CNOOC, expects to deploy 10 floating production, storage and offloading vessels in Guyana’s Stabroek Block, where there are an estimated 10 billion barrels of oil equivalent in reserves.

According to S&P Global Platts Analytics, total production could reach 1 million b/d by 2030 if other discoveries come online.

The prospects for transporting oil may only continue to grow for a few more years but the decline will also be gradual. The oil industry has moved from a view of peak oil prompted by supply to one prompted by demand, De Stoop said.

De Stoop sees peak oil demand in the middle of this decade.