Should CGX Energy Inc. and its partner, Frontera Energy Corporation move to produce its Kawa-1 discovery in the Corentyne Block, Vice President Dr. Bharrat Jagdeo has assured that better fiscal terms will be secured in its Production Sharing Agreement (PSA).

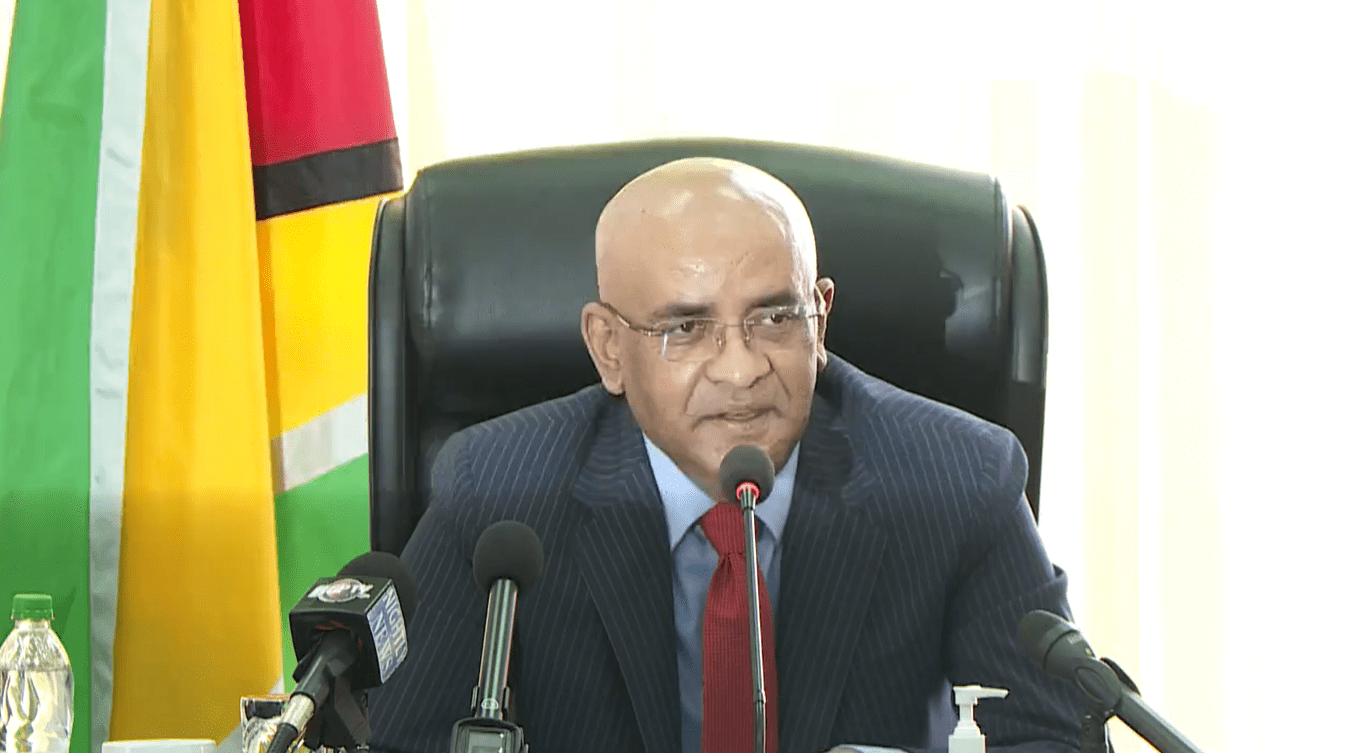

This was noted by Mr. Jagdeo during a press conference on Thursday at the Arthur Chung Convention Centre (ACCC). The former Head of State who holds responsibility for policy in the oil sector said the latest discovery now increases the pressure on government to get its model PSA in order. Jagdeo said this was initially placed on the backburner since ExxonMobil was the only company landing all the significant, world-class discoveries in the Stabroek Block.

Given the change in circumstance, time is of the essence to ensure the State has a new set of fiscal terms that address the treatment of taxes, higher royalties and ring-fencing, the Vice President stated. He said these will all be looked at when CGX and its partner are ready to enter into a PSA.

The Vice President said, “So there will be better terms when the time comes for the CGX PSA. The PSA will see better terms for Guyana as opposed to the one signed for Stabroek Block. I don’t want to get into too many details about issues raised such as high royalty rate, and ring fencing, those have to be looked at along with tax treatment and a whole range of other issues…”

The official added, “There are about 10 or 11 areas we identified to look at and they have to do with the fiscal terms.”

Jagdeo further noted that it is in the country’s interests to move swiftly on these matters since Guyana has a very short window within which to exploit its resources and get the most for it given the energy transition movement.

He said, “Let me be nuanced too because I like to be clear for people to understand. We have a window within which we want to accelerate production to transform what is a buried asset, and might become stranded, into a financial asset and so we therefore have to take that into account, but the conditions will be better.”

It was on Monday that CGX announced it had struck oil at Kawa-1 after more than 20 years of seismic data acquisition and drilling on the Corentyne Block.

CGX and partner Frontera Energy Corporation said the Kawa-1 well was drilled to a depth of 21,578 feet (6,578 metres) on the northern section of the block and encountered approximately 177 feet (54 metres) of hydrocarbon-bearing reservoirs within Maastrichtian, Campanian and Santonian horizons based on initial evaluation of Logging While Drilling (LWD) data.

For a comparison, ExxonMobil’s Whiptail-2 well announced in July 2021 had encountered 167 feet of hydrocarbon-bearing reservoirs while Hammerhead, announced in August 2018, had encountered 197 feet of hydrocarbon-bearing reservoirs. Both were said to be significant discoveries with potential for standalone development. With gross pay at Kawa-1 falling right in the middle of these two discoveries, CGX and Frontera seem to have finally hit the jackpot.

The partners said the intervals at Kawa-1 are similar in age and can be correlated using regional seismic data to recent successes in Block 58 in Suriname and the Stabroek Block in Guyana. They said too that Kawa-1 also encountered hydrocarbon-bearing sands in deeper strata (Coniacian or older). The companies said this will be analyzed and could become the target of future appraisal opportunities.

Further to this, CGX and Frontera said the net pay and fluid properties of the hydrocarbons across the shallow and deep reservoirs will now be confirmed with electric wireline logging and fluid sampling, with results to be disclosed as soon as practicable.

Both disclosed that the Kawa-1 results support the geological and geophysical models used while noting that they have helped de-risk equivalent targets in other parts of the Corentyne license area. The end of well forecast is currently projected to be the end of February 2022.

Significantly, the partners are now eager to build on their recent offshore positive results at the Kawa-1 exploration well, with plans moving apace to spud its second commitment well, called Wei-1, in the northwestern part of the Corentyne block in the second half of 2022.

CGX is the operator of the Corentyne block with a 66.667% participating interest, with Frontera Energy Corporation holding a 33.333% interest.