All eyes will be on Guyana come September when the country opens its first offshore bid round. This will be a major step for Guyana, a country that has never handed out oil licenses through a competitive process.

Oil and gas bid rounds help countries like Guyana get the most value from their natural resource. And since this one is Guyana’s first, here’s how a typical auction process goes.

The bid round would kickstart with an announcement by the executing agency. In Guyana’s case, this would be the Ministry of Natural Resources. The announcement would name the blocks up for grabs and their accompanying data, like size and location.

In addition to information about the blocks, the government will have to establish the terms prospective licensees will operate under. Guyana is working to finalise a model petroleum agreement for use in this auction.

Governments may make certain terms into biddable items. For example, if the profit oil split is a biddable item, the company that offers Guyana the highest portion of profit oil is more likely to win the award.

Excluding Exxon, other operators could reduce competitiveness of auction – VP | OilNOW

It is typical for there to be a participation fee for interested investors to have access to information on the open acreage to complete their evaluations. It would include geophysical data like 2D or 3D seismic surveys, well and field data.

With that technical package in hand, the investors can now evaluate the prospectivity of blocks and may propose a work program as a biddable item. This could include additional assessments and a number of wells to be drilled.

There is also a pre-qualification process where the interested investor has to show proof of its technical, legal and financial assurance to guarantee that it is competent enough to develop the block.

Guyana’s September auction will not include onshore blocks – VP | OilNOW

At the launch of the auction, government will indicate the deadline for submission of bids. Vice President Dr. Bharrat Jagdeo said the auction is likely to be launched in September and conclude by January or February next year.

At the bid’s closure, the investors would have already submitted all pertinent documents – bid form, cash bonus, bank guarantee – all part of their proposals. A government-appointed committee then opens and evaluates the bids based on set criteria or a point system.

Successful proposals are usually bids with the highest points. The blocks are then awarded so that work can begin, on the signature of a contract. In some cases where there is a tie, a signature cash bonus is used to select a winner, or the investors and the evaluation committee negotiate.

Countries like Brazil, Suriname, and Trinidad and Tobago have their own unique offerings to attract investor interest during bid rounds. Not every bid round will follow the same process or apply the same rules.

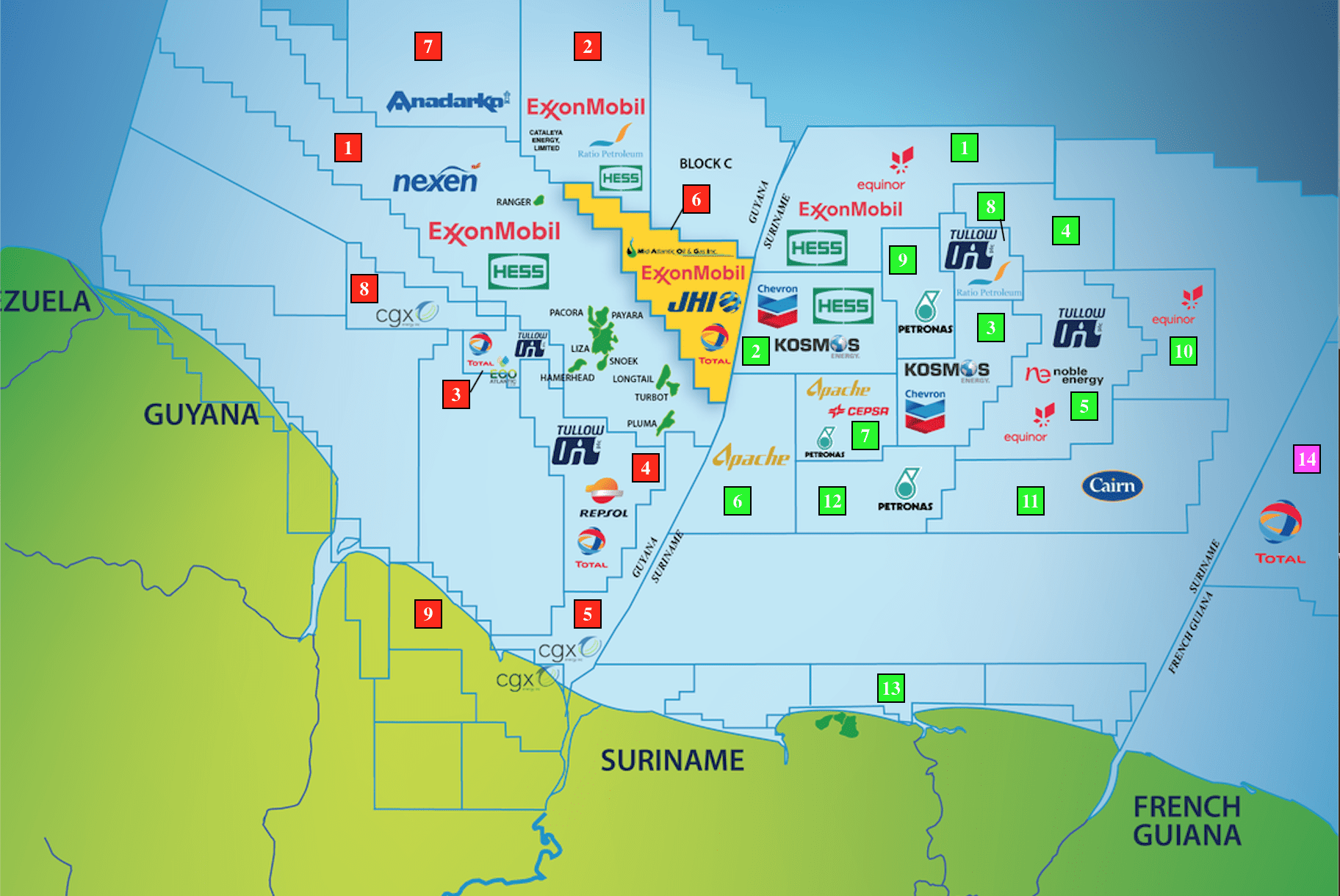

Interest is already high for Guyana’s bid round, with investors looking to grab up major portions from Block C – a deepwater acreage – bordered by the Kaieteur and Canje blocks, and the Suriname border. There is also a lot of interest in the relinquished portion of the Canje block, with an area of about 1,352 km2.

Almost a third of the acreage in the Guyana basin remains unlicensed; those could be up for grabs at the new bid round. And the possibility exists for the acreage to increase if conditions of relinquishment are added to the new open areas.