By Ivelaw Lloyd Griffith

This is the second article in the two-part series on Guyana’s petroleum pursuits and the likely impact of climate change dynamics on those pursuits. In the first, I looked at oil production and noted some of the climate change circumstances at play. In this one, I will ponder some of the environmental security implications involved.

Environmental Security

Guyana faces some clear and present dangers in the area of environmental security. By environmental security, I mean circumstances where environmental-related/caused problems severely compromise the ability of state power holders to exercise normal political, economic, and military rule, which in turn, undermines the state’s internal governance or external sovereignty.

Understandably, citizens of Guyana have—and will continue to have—expectations that the country’s oil bounty will benefit them. Yet, there is a great risk that the environmental security challenges on the horizon will diminish individual and societal gains from the oil revenues if the environmental security challenges are not addressed with what the Rev. Dr. Martin Luther King, Jr. once called “a fierce urgency of now.”

Yes, the rising sea levels might only minimally affect offshore drilling. However, the rising waters and other manifestations of climate change will disrupt habitation and societal normalcy—and not just in Georgetown—such that the new wealth might hardly benefit the people there. Yet, for the first time, Guyana is set to have the resources to undertake a project of this magnitude, thanks to growing oil revenues. Thus, the country’s leaders face a long-term existential imperative: to begin using some of the oil revenue to craft what might be called an Environmental Security Investment Plan. Such a plan could have two components: a short-term one, and a long-term, transformational, one.

Maintenance of the sea defenses, clearance, revetment, and maintenance of the canals and kokers, and repair/replacement and maintenance of water pumps would be key aspects of the first component. Restoration and maintenance of mangrove forests and the rehabilitation and maintenance of the coastal wall would be key aspects of the second component. Beyond this, the relocation of Georgetown away from the doorsteps of the Atlantic Ocean is a sine qua non for the long-term societal transformation that leaders and citizens desire and deserve.

The government is to be lauded for the current construction of Silica City, a new urban community 30 miles outside Georgetown and 33 miles from the mining town of Linden, with 3,800 acres of state land. It is envisioned as a “smart city” with residential and non-residential areas, a tourism district, and a conservationist district, and featuring sustainable urban drainage, alternative energy, and modern waste management. Indeed, one government minister promised it will be “a marvel.”

However, the creation of this new habitation enterprise does not diminish the coastal threat; the environmental security threat to the coast persists and will worsen with the rising sea levels, especially as the oil boom is creating a dizzying pace of commercial and residential expansion in Georgetown and its environs. Thus, while the creation of Silica City is desirable, it’s not sufficient. The relocation of the capital should still remain a serious long-term project.

Georgetown’s relocation has been contemplated since the 1970s but has been stymied by issues of political will, societal intransigence, and financing over the years. As economist Jay Mandle noted, “There is much-justified excitement concerning the country’s future as a petroleum exporter. But the need to use those funds to settle the Interior has not been the subject of public discussion. … Overcoming this reticence and debating the merits of Interior development is something that should begin soon. Without a society-wide dialogue on climate change, the opportunity to forge a consensus on how to use petroleum revenues in responding to coastal flooding will be lost. The risk of such a failure is that when circumstances do finally force the society to relocate, it will be unprepared to do so in an orderly and systematic way.”

Foreign assistance certainly would be necessary to help address the extant environmental security challenges, especially the relocation of the capital. Truth be told, the country does currently receive considerable flood mitigation and other climate change-related assistance—on both a bilateral and a multilateral basis. However, this oil-power-in-the-making cannot rely on external assistance to strengthen its environmental security; it needs to put some financial “skin in the game.”

Sovereign Wealth Fund

The nation has been laying the basis for some of the necessary “skin in the game,” with the accumulation of its some of its oil fortunes in a sovereign wealth fund called the National Resources Fund. The National Assembly passed the Natural Resource Fund Act 2019 on January 3, 2019. It was later replaced by the Natural Resource Fund Act 2021, which the National Assembly passed on December 29, 2021.

The Fund is held at the Federal Reserve Bank in New York. Among other things, the Fund is envisioned to ensure that volatility in natural resource revenues does not lead to volatile public spending; guarantee that natural resource revenues do not lead to a loss of economic competitiveness; transfer natural resource wealth across generations to ensure that future generations benefit from natural resource wealth; and use the natural resource wealth to finance national development priorities. The relocation of the capital should be declared as one of the priorities.

In 2022, the Fund received just over US$1,099 million in profit oil payments and US$155.2 million in royalties. After the transfer of US$607.6 million (earned in the period 2020-2021) to the government’s budget to fund various initiatives, the Fund had a 2022 end-of-year balance of US$1,271.8 million. According to the Fund’s report for the first quarter of 2023, the balance in the account was US$1,464.57 million to be exact, with the country expecting tens of billions more in coming years. Yet, no matter how plush Guyana’s sovereign wealth fund, it would be imprudent for its leaders to have such funds provide the only “skin in the game.” Green bonds, one form of climate financing, could provide complementary support, as part of a broad funding package.

In the final analysis, Mother Nature’s power and presence in the nation which is five times the size of the Netherlands, an erstwhile coloniser, make true not just the declaration “water, water, everywhere,” but also the assertion “oil, oil, plenty there!” Accordingly, Guyana finds itself on both the negative and positive sides of the climate change balance sheet: it provides a carbon sink but also produces fossil fuels that add to global warming, a key ingredient of climate change. This is all the more reason for Guyana’s leaders to craft and implement an Environmental Security Investment Plan.

About the Author

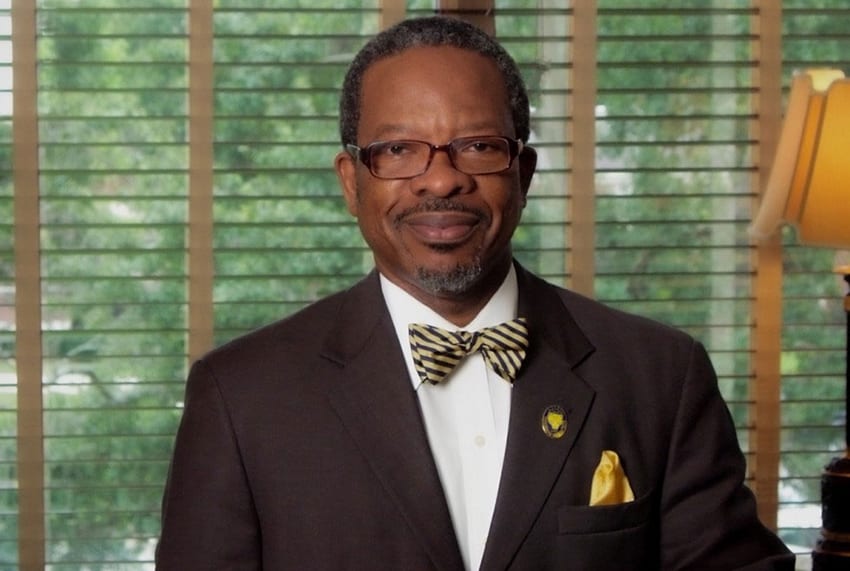

Ivelaw Lloyd Griffith, a former Vice Chancellor of the University of Guyana, is a Fellow with the Caribbean Policy Consortium and Global Americans. His next book, Challenged Sovereignty: The Impact of Drugs, Crime, Terrorism, and Cyber Threats in the Caribbean, will be published by the University of Illinois Press.