(Reuters) – Oil rose on Tuesday amid hope that the world’s biggest producers of crude will agree to cut output as the coronavirus pandemic crushes demand, even as analysts warn a global recession may be deeper than expected and big production cuts will be needed.

Brent crude LCOc1 was up by 80 cents, or 2.4%, at $33.85 a barrel by 0657 GMT after falling more than 3% on Monday. West Texas Intermediate (WTI) crude CLc1 was up by 83 cents, or 3.2%, at $26.91 a barrel, having dropped nearly 8% in the previous session.

The world’s main oil producers including Saudi Arabia and Russia are likely to agree to cut output at a meeting on Thursday, although that would depend on the United States joining in, sources told Reuters.

But the threat of a major recession hangs over the market due to the halt of much economic activity as a result of the coronavirus pandemic, with half the global population under some form of lockdown or social distancing measures.

“Anything less than a coordinated global cut is going to be disappointing to the market, as further price declines will be necessary to shut in enough output,” said Greg Priddy, director global energy and Middle East at Stratfor in Houston.

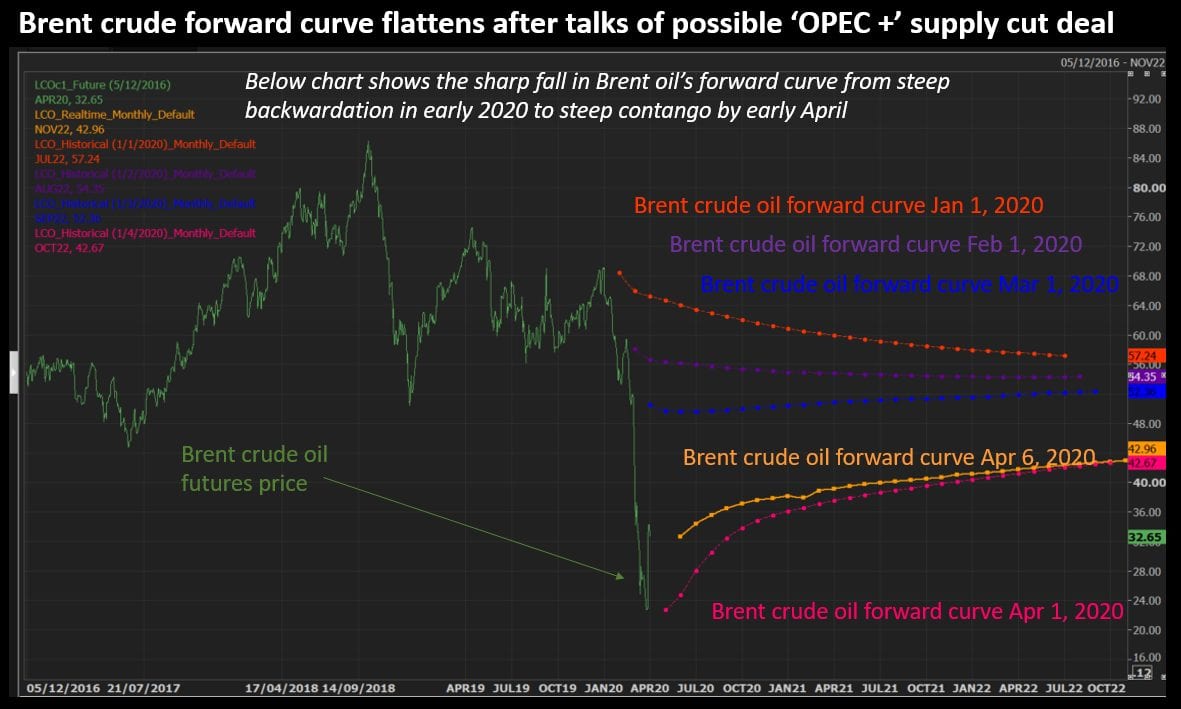

Worldwide oil demand has dropped by as much as 30%, or about 30 million barrels per day, coinciding with moves by Saudi Arabia and Russia to flood markets with extra supply after an agreement on withholding output fell apart.

Oil prices slumped on Monday after Saudi Arabia and Russia delayed a meeting to agree on output cuts till Thursday.

The Organization of the Petroleum Exporting Countries (OPEC) and other producers including Russia, a grouping known as OPEC+, had been curtailing production in recent years amid a rapid expansion of U.S. output that made the country the world’s biggest crude producer.

There are questions whether the U.S. would join any coordinated action.

U.S. President Donald Trump said on Monday that OPEC had not asked him to push domestic oil producers to cut their production to buttress prices. He also said that U.S. output was declining in response to falling prices.

“I think it’s happening automatically but nobody’s asked me that question yet so we’ll see what happens,” the president told a press briefing on Monday afternoon.

Coordinated action by U.S. oil producers to reduce output would typically be a violation of antitrust laws.

A global recession that economists in a Reuters poll say is under way will likely be more serious than expected a few weeks ago due to the viral outbreak, the latest survey showed.

“We expect energy prices to hover around current levels until economic activity recovers,” Capital Economics said in a note.