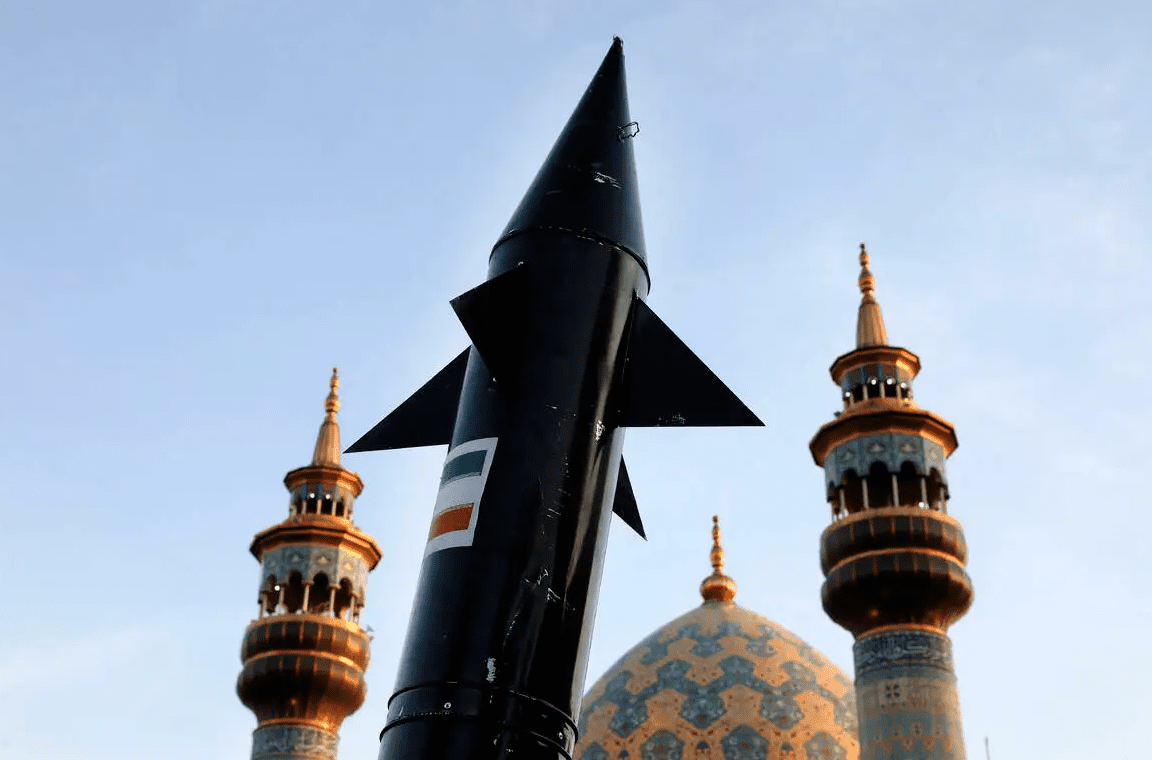

Iran unleashed a barrage of over 300 drones and missiles on Israel over the weekend, marking the first direct assault on Israeli soil from Iranian territory. Jorge León, Senior Vice President at Rystad Energy, described this as an “unprecedented and dangerous development in an already volatile region.”

Ongoing Israel-Hamas conflict threatens regional natural gas market and Europe’s LNG supply | OilNOW

The aftermath of Iran’s attack has sent shockwaves through the global oil market, with Rystad Energy’s weekly Geopolitical Risk Index soaring to 1.35 during the second week of April. Rystad Energy said this spike represents the highest level recorded since the year began. Moreover, looking at the last couple of days alone (April 13 and 14), Rystad Energy’s index surged even further to 1.41, indicating escalating tensions and heightened uncertainty.

Jorge León shed light on the impact of these geopolitical tremors on oil prices, stating, “As an Iranian retaliation became imminent in the run-up to Saturday, oil prices started to increase last week. Brent closed at US$90.5 a barrel on Friday.” He further noted that Rystad Energy’s analysis pegs the “fair value” of Brent for April, based solely on supply and demand fundamentals, at around $84 per barrel. Thus, the recent 10% price surge can largely be attributed to the unfolding conflict.

Elevated geopolitical risks in Europe, Middle East pushing oil prices up | OilNOW

The pivotal question now looming over the markets is the trajectory of this crisis. León poses, “Is this the start of a direct war between Israel and Iran and its allies, or was Iran’s attack a calibrated and well-telegraphed retaliation?” The answer to this question carries immense significance for oil markets globally.