Extreme price volatility has been a key feature of the oil industry and can have a major impact on the ability of governments to plan effectively on how to invest oil revenues. The outbreak of the coronavirus has further exacerbated the wild price fluctuations the industry has always been prone to, and even with the rollout of vaccination measures, much remains uncertain.

Various analysts and experts in the industry have been trying to get a fix on what the price per barrel of oil will be this year. The projections range from $50 to $60 with some anticipating that the price could climb as high as $65 by June. Others warn that with concerns over new strains of the coronavirus emerging and the prospect of lockdown measures being reimplemented in some countries, oil prices could drop below $40.

But what does it all mean for oil producing countries where development goals and economic policies being implemented by the government hinges in large part on the expected revenues from oil production?

Qatar, for example, has said that it will base its budget on an oil price of $40, below what markets expect. The move will help Qatar “avoid negative economic consequences due to oil-price volatility,” Emir Sheikh Tamim bin Hamad Al Thani told members of the country’s legislative body, the Shura Council, in November.

Energy Market expert and President of the Rapidan Energy Group, Robert McNally, even before the outbreak of the pandemic had urged new oil producer Guyana to be cautious in its approach to spending.

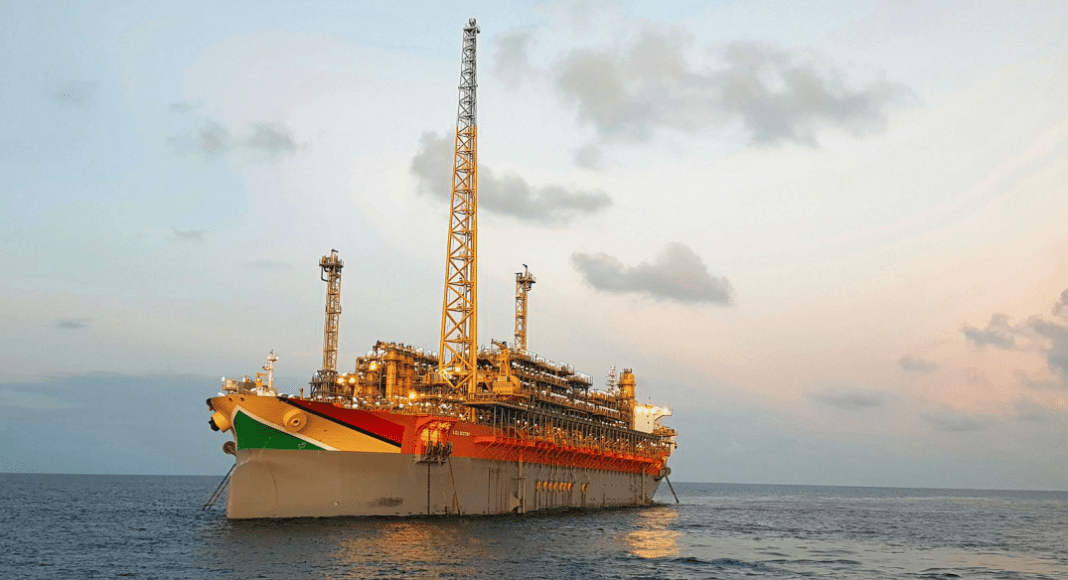

The country is poised to become the biggest per capita oil producer in the world in coming years and could be the number two producer in Latin America by the end of the decade.

“We have a lot of mistakes that were made by other countries; hopefully, Guyana will miss it. Most importantly, don’t spend the money you don’t have,” McNally warned during a visit to the South American country last year.

He reminded at the time that oil as a commodity is prone to wild price swings because of the nature of supply and demand. “On the demand side it’s a must-have commodity…and on the supply side; once you start that field, governments and operators don’t want to shut down, even if the price falls very low,” he stated.

For its part, authorities in Guyana have said they intend to ensure a robust mechanism is in place before moving to spend revenues being collected from oil production. The country has already received close to US$200 million in oil revenue since production began in December 2019.

“First of all, we have to put the mechanism in place. We have to ensure we have robust laws. We have to have robust management systems,” President Irfaan Ali has said. “We have to have the right governance structure before we think about touching the resources and we have to have that Sovereign Wealth Fund well thought out, one that acts in the immediate needs of our country while at the same time safeguarding the future generations.”

The bill for the Sovereign Wealth Fund, known in Guyana as the Natural Resources Fund, was passed in the country’s National Assembly in January 2019. Since that time, an account has been set up in the United States to receive the proceeds of oil sales and royalty.