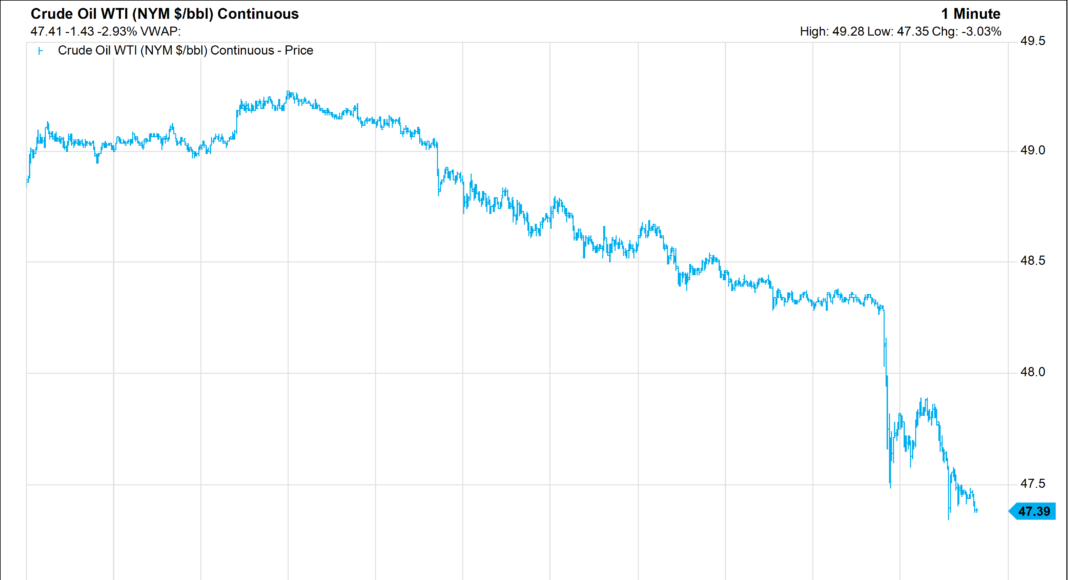

(CNBC) Oil prices sharply extended losses just before Tuesday’s settlement, with U.S. crude breaking below $48 a barrel for the first time in more than a month.

U.S. West Texas Intermediate futures and international benchmark Brent crude were both down more than 2 percent. The contracts surrendered gains earlier in the session as rising output in the United States, Canada and Libya offset news of falling production in Russia and OPEC.

U.S. crude was down $1.35, or 2.8 percent, at $47.49 shortly after 3 p.m. EDT, having struck its lowest level since March 27. Brent fell $1.15, or 2.2 percent, to $50.37.

John Kilduff, founding partner at energy hedge fund Again Capital, pointed to a Bloomberg report that the Libyan prime minister and a rival commander had agreed to set up a power-sharing council.

Civil unrest has crimped the country’s oil production due to repeated shutdowns of oil fields and pipelines. Libya is one of two OPEC members exempt from the exporter group’s deal to cut combined production by 1.2 million barrels a day in the first half of 2017.

“The interpretation would be that Libyan production and exports would be increasing in the next couple of months, adding to supplies in an already oversupplied market,” said Andy Lipow, president of Lipow Oil Associates.

On Monday, Libya’s National Oil Co. said production had risen to the highest level since December 2014 and indicated it would continue to increase output, Reuters reported. That has added a bearish sentiment to the market, Lipow said.

Roberto Friedlander, head of energy trading at Seaport Global Securities, also referenced comments by the powerful Saudi deputy crown prince that suggested Riyadh may be ready to resume its battle for market share with other producers.

“The fact is it’s not about one particular headline but more about the fears that are finally coming true; we have watched production cuts hold steady while exports grow,” Friedlander said.

U.S. production “continues to grow hand over fist, and the market will remain well oversupplied given the lack of” refined fuel demand, he added.

Traders are looking forward to an industry report on U.S. crude oil and fuel stockpiles at 4:30 p.m. EDT, to be followed by government data Wednesday at 10:30 a.m. EDT.

Analysts expect a decline of 2.2 million barrels of crude in storage but a rise in fuel inventories, according to a Reuters survey.