After the pandemic decimated the oil and gas industry in 2020, this year is being seen as one of rebound with oil prices rallying and investments picking up across various projects globally, chief among them being South America’s hottest new offshore province – Guyana, where a 9 billion USD project is expected to be sanctioned soon by ExxonMobil.

“We’ve seen a price rally for Brent that has allowed it to more than double since the beginning of the year, as demand recovers and supply stays (artificially) tight,” says Schreiner Parker, Rystad Energy’s Senior Vice President and Head of Latin America. “The Latin America region has also seen its fair share of success stories in 2021. Vaca Muerta production keeps delivering, sanctioning activity remains high in Guyana, and Chile continues to take the forefront in energy transition and renewable investments.”

“Guyana is another area that 2021 has treated well,” Parker noted, pointing out the string of discoveries the U.S. oil major has made this year, totaling five so far – Uaru-2, Longtail-3, Whiptail-1, Pinktail-1 and Cataback-1. These new discoveries have pushed the resource estimate to 10 billion barrels of oil equivalent.

“As Exxon and their partners continue to work with the Government of Guyana to implement and approve development plans for the discovered resources there will be more work to be allocated to various components of the OFS [oilfield services] supply chain. Count on this expenditure to continue through to next year and well beyond,” Parker said.

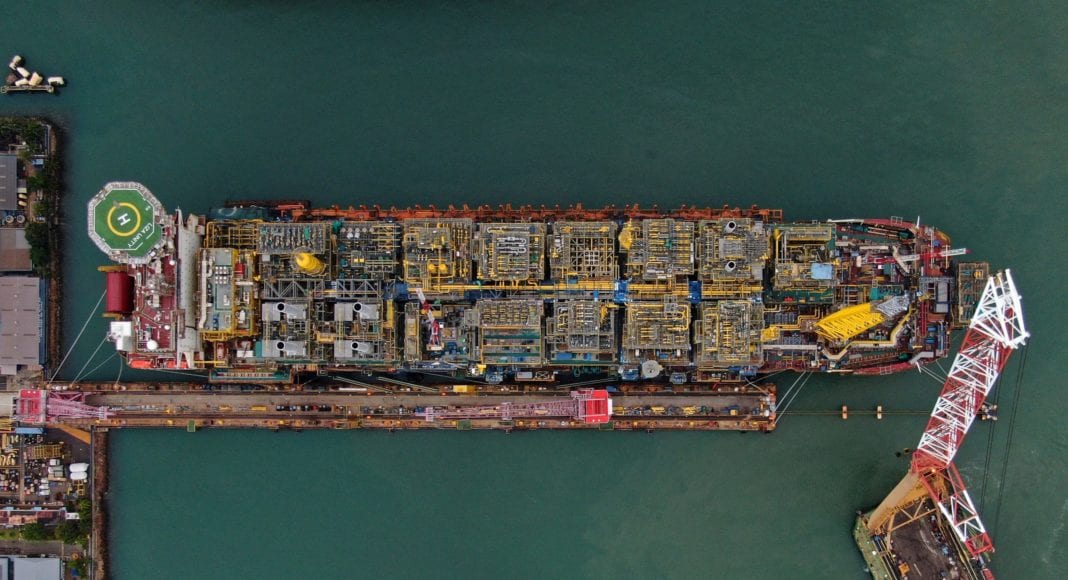

Guyana’s biggest project to date and one of the largest subsea developments this century is pending government approvals. Yellowtail will deliver a whopping 250,000 barrels per day (bpd) at the ExxonMobil-operated Stabroek Block by 2025, pushing Guyana’s total output well over 800,000 bpd.

Yellowtail will develop largest resource base to date, Pinktail and Whiptail could be 6th project

What is OPEC saying?

In its Monthly Oil Market Report for November, the Organization of Petroleum Exporting Countries (OPEC) said the main drivers of 2021 supply growth continue to be Canada, Russia, China, Norway, Brazil and Guyana. The forecast for non-OPEC liquids supply growth in 2022 is 3.0 mb/d, averaging 66.7 mb/d.

Hess says Guyana production could hit 1.5 million bpd before 2030

“Russia and the U.S. are expected to be the main drivers of next year’s growth, contributing increments of 1.0 mb/d and 0.9 mb/d, respectively, followed by Brazil, Canada, Kazakhstan, Norway [and] Guyana,” OPEC said.