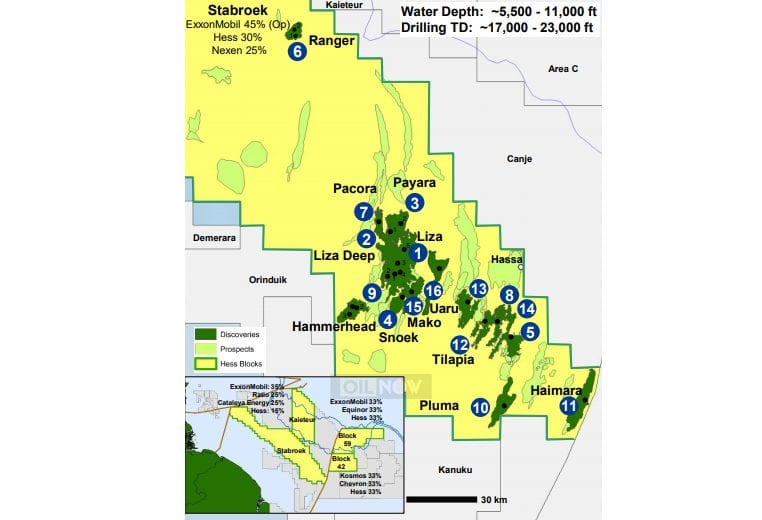

In providing asset highlights during an investor presentation on February 11, Hess Corporation said the 16 discoveries made so far at the Stabroek Block offshore Guyana are characterized by exceptional reservoir quality and low development costs. The company holds 30 percent interest in the Stabroek Block, along with ExxonMobil with 45 percent as operator and another co-venturer, CNOOC, with a stake of 25 percent.

Referring to the Stabroek Block as a world class investment opportunity, Hess said that with more than eight billion barrels discovered and with multi billion barrels of remaining exploration upside, it is among the largest oil discoveries over the past decade.

The company noted the Stabroek Block’s exceptional reservoir quality coupled with its low development costs of $35/bbl Brent breakeven for Liza Phase 1 and $25/bbl Brent breakeven for Liza Phase 2.

Hess cited the block’s shallow producing horizons, requiring less than half the drilling time and costs when compared to typical offshore deep-water exploration.

The company noted that the Stabroek Block benefited from attractive development timing as it was near the bottom of the offshore services cost cycle and that it has seen a 30 percent decrease in drilling costs. The gross development costs for Liza Phase 1 was also reduced from $4.4 billion to $3.5 billion, as previously reported.

Hess said that next steps in the Stabroek Block is to perform drill-stem tests at Yellowtail-1, drill and test Yellowtail-2 and Longtail-2 and begin Liza Phase 2 development drilling.

Rystad Energy has said Guyana’s oil production could reach 1.2 million barrels per day by the end of the decade, lifting total annual oil revenues to about US$28 billion, assuming an oil price of about US$65 per barrel. Government income in the country – projected to be a modest US$270 million or so in 2020 – is forecast to grow rapidly and could reach nearly US$10 billion annually within a decade.