By Cristina Caus – OilNOW

The Gas-to-Energy project is an embodiment of Guyana’s mission to transform its historically underperforming economy, now one of the fastest growing, into a world-class and competitive environment. The GtE project represents one of the largest single-expenditure projects in the history of Guyana.

Planned as a 25-year joint venture between the Government of Guyana and ExxonMobil with a cost of approximately US$ 2 billion, the project is designed to supply natural gas from the Stabroek block through a 12-inch diameter pipeline that will run 220km to the onshore Wales Development Zone on the West Bank of Demerara, connecting to a facility that is slated to encompass a 300 MW natural gas power plant and a natural gas liquids (NGL) plant. When completed, these two facilities will be capable of producing at least 4,000 barrels per day, including the fractionation of liquefied petroleum gas (LPG). The NGL processing plant will treat the gas to extract NGLs for commercial use, and the power plant will use the dry gas to generate electricity for domestic use. Later developments could include plants for producing ammonia and urea.

The Project is one of a kind and it consists of two phases: 1. Pipeline installation coming at an estimated cost of US$1.3 billion. Exxon is going to manage the installation of the subsea pipeline on the seafloor to transport the natural gas from the Liza field to the onshore pipeline, with a minimum of 50 million standard cubic feet of gas per day capacity (mmscfd) and a maximum capacity of 130 mmscfd. and 2. The construction of the gas power plant and the integrated NGL plant, managed by the US-based partnership CH4/Lindsayca at a cost of approximately US$759 million. The project is expected to come online by the end of 2024.

In its anticipation, the Petroleum Management Programme under the Ministry of Natural Resources of Guyana released the Gas Monetization Strategy which serves as a discussion paper for citizens and experts to share their opinions with the government on the project and the strategy to manage Guyana’s substantial gas resources.

Given the size, scope and cost of the project, some are skeptical and find it difficult to determine the feasibility of it; and there are aspects that need to be analyzed.

Is Guyana truly ready for a project of this scale?

Resource wise – yes. The Guyana-Suriname basin is known to contain large amounts of natural and associated gas as well as crude oil. Gas accounts for about 25% of the 11bn barrels of oil equivalent (boe) in recoverable reserves discovered at Stabroek. According to estimates, the proven gas reserves are at 17 trillion cubic feet (tcf). , The associated gas is currently used for pressure maintenance and enhanced oil recovery, but it is considered to be trapping a substantial quantity of oil, therefore limiting the oil exploration and production capabilities as well.

Infrastructure-wise Guyana hasn’t been ready for this sudden oil and gas turn of events to start with. The country was in a similar dilemma a few years ago when it started offshore operations. It didn’t have the adequate infrastructure, financial and workforce capability to embrace this sprouting industry and that’s where a leap of faith was required. Up to date, ExxonMobil and its contractors spent more than US$900 million with locals since the first discovery in 2015. By the end of 2022, the company and contractors employed over 5,000 Guyanese workers, representing more than 65% of the overall workforce in the local oil and gas industry.

With no experience or offshore infrastructure, Guyana just in four years managed to have acquired two FPSOs (at an approximate cost of about $1B each) actively operating in its deep waters, with one more expected to be delivered by the end of 2023 and three more targeted by the end of 2027. That’s a total of six floating production storage and offloading vessels, quite an impressive portfolio of assets for a beginner like Guyana, and a solid investment for a supermajor like Exxon. This agile responsiveness to its petroleum infrastructure and workforce needs to be integrated with foreign partnerships, investments and skills transfer is a harbinger of how Guyana can manage complex infrastructure projects, such as the Gas to Energy one and how competitive it can get on the global market.

The costly infrastructure investments if coupled with the right maintenance practices have a quite long lifespan, between 30-50 years for the Gas power plants and the NGL plants and an average of 50 years for the natural gas transmission pipelines; long enough to pay off the hundreds of millions of dollars it takes to build them and longer in comparison for example with the solar power plants that on average would last 25-30 years, wind farms that have an expected lifetime of around 20 years, while energy storage last roughly 10 years.

Financially wise – yes, but this requires caution. In the past two years the global events have been favoring the commodity prices therefore creating more oil revenues for the oil producing economies, including Guyana, who has pocketed about US$1.24 billion in revenue from oil sales and royalties annually since first oil production in 2019.

The key to economic stability for a country is a balanced wealth management and distribution strategy. Often happens that developing countries who get blessed with wealth from resources initiate generous spending, expensive projects and acquisitions which mostly lead to exaggerated loans and burdening debts. That’s the case of many oil exporters, eight out the top 35 net oil exporters from 1979 to 2010 have defaulted on their debt during that period, some of them are Argentina, Sudan, Iran, Iraq, Russia, Mexico, Egypt.

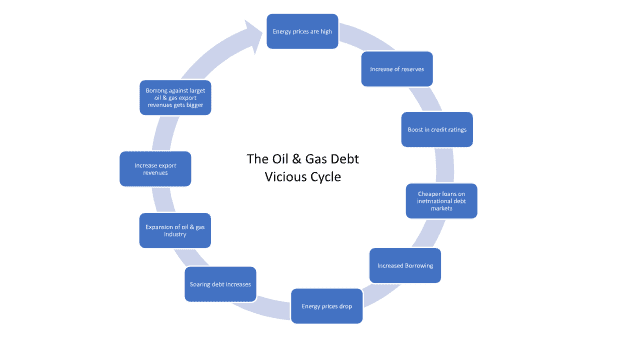

While considering a project of this scale, it is important to pay attention to maintaining a good debt-to-GDP ratio. The relationship between abundant fossil fuel reserves and rising debt is no coincidence and many of the countries facing debt distress have significant oil and gas reserves. Many oil exporting economies get trapped in this vicious cycle where they benefit from increasing oil revenues which increases the value of their reserves and boosts their credit ratings, enabling them to get more loans, when the oil prices drop the debt is heavier pushing the economy to expand the fossil fuel sector more and rely more on the revenues it generates, which gets attractive for creditors but becomes a heavy burden for the economy, as it gets more indebted. As a rule of thumb, a good debt-to-GDP ratio is usually under 60%. Guyana was at 27.80% in 2022, expected to reach 30.00 percent of GDP by the end of 2023. According to the IEEFA Guyana’s debt will skyrocket from US$621 million in 2023 to an overwhelming US$1.7 billion in 2027, primarily fueled by the Gas-to-Energy initiative. On the other hand, Guyana’s GDP is forecasted to see tremendous growth as well, reaching US$ 29.94 billion by 2028, placing it somewhere in the 58% debt-to-GDP ratio.

Figure: The relationship between abundant fossil fuel reserves and rising debt

If we are to do a quick math around the Gas to Energy project, the pipeline installation by Exxon will commit Guyana to pay annually for the next 20 years a fixed rate of US$55 million to Exxon, this amount is the amortized cost of US$1 billion for 20 years at a discount rate. The natural gas and the LNG plant facilities are to be financed by the government, for 2023 about $US 200 million were allocated from the budget while the other portion of approximately US$646 million is pending financial approval the government is seeking from EXIM.

The flip side of the coin is that currently about 90% of Guyana’s power generation capacity comes from heavy fuel oil. The GtE project would be saving about US $11 million that is used to pay for fuel every single month in addition to reducing electricity prices by an estimated 50%, which currently is at a rate of 15 US cents per kilowatt hour. Also, according to the Winston Brassington, Head of the Gas-to-Energy Task Force, it is estimated that the commercialization of the excess NGLs will earn Guyana about US$100 million per year, providing the revenues to meet the annual payments and make a profit.

We should also consider the potential revenues from branching out the GtE project as highlighted in the Gas Monetization Strategy. The production of fertilizers, such as ammonia, can contribute enormously to the diversification of the project and the economy. Natural gas is the primary feedstock for ammonia, the building block for all nitrogen fertilizers, and accounts for 70-90% of production costs. If we take a look at the fertilizer market, it is roughly increasing by 12% compared to the previous years and it is forecasted to surpass US$ 240 billion by 2030. Trinidad and Tobago can serve as a good example of how profitable it can become, as in 2021, T&T exported US$1.74 billion in ammonia, the most exported product in the country and placed the nation as the second largest exporter of ammonia in the world. The Russia- Ukraine war has destabilized the fertilizer market globally, as they both were large fertilizer producers, therefore creating an opportunity for newcomers as Guyana.

There has been constant discouragement addressed by some global organizations and individuals towards Guyanese pursuit of its fossil fuels resources from the beginning. The kind of” in the right place at the right time” opportunity isn’t presented every day and wouldn’t Guyana have taken the risk to invest in its oil exploration and production it would not become the fastest growing economy in the world in few years only blessing its citizens with a phenomenal GDP per capita growth from about US$6.950 in 2020 to $US 20.000 in 2022 with a forecasted 80.74% continuous increase to about US $37.000 by 2028.

Some are worried that this project will indebt the country for many years to come and some even claim, as the U.S. based Institute for Energy Economics and Financial Analysis (IEEFA), that the project is “unnecessary and financially unsustainable”, advising that Guyana could use its oil profits for a reliable, low-cost rooftop solar solution that would save billions while providing low-carbon electricity to the entire country.

Renewable energy is indeed a good solution developed in parallel, however, it is an intermittent variable power and it needs to be balanced with a stable and reliable source, such as natural gas, which is a low-carbon energy source compared to current HFO being used. Moreover, renewable energy, as solar suggested by the IEEFA, would address a portion of country’s economic challenge, which is energy generation, however, would not create the other economic opportunities as some described earlier. The massive economic growth in Guyana is creating a huge demand for energy supply and for serious investments in grid modernization, transmission lines and substations for integration. Nevertheless, the fact that Guyana has natural gas in abundance should be considered as a step towards diversification of its energy portfolio and energy security and transition plans, while combined with renewable energy projects. A healthy approach is required that considers economic expansion into new sectors, development of new projects, reliable partnerships and investments that align with the country’s needs and global market demand in a sustainable and financially sound way.

About the Author

Cristina Caus is an International Economist and Oil and Gas/Energy Consultant and Business Developer. She has over a decade of rich experience in the oil & gas industry worldwide and holds a master’s degree in international business from FIU.