“Quite successful” was the review given by Americas Market Intelligence (AMI) Energy Co-Director, Arthur Deakin, to the results of Guyana’s first licensing round. However, the analyst says more transparency is needed regarding details of the bids.

The bids were opened at the National Procurement and Tender Administration Board (NPTAB) on Sept. 12. Just the names of the six groups that made submissions were released. Guyana’s Vice President, Bharrat Jagdeo, at a later press briefing shared that 14 bids were submitted, in total, while six of the blocks received no bids.

“There is not much information on the bids, the amount of capital promised or committed…by any of the bidding companies,” Deakin told OilNOW. He emphasised that this is the area in which more transparency is needed.

“There should be a place where any individual can go online and check what the bids were and then who submitted them. I think that is something that is pretty simple and that could improve the overall bid round,” he explained.

Guyana’s maiden bid round targeting minimum of US$170M in signing bonuses | OilNOW

Section 6 of the new Petroleum Activities Bill of 2023 says “The Minister shall publish the details of an application for a licence by notice in the Gazette.”

To date, Guyana’s Official Gazette remains void of any information regarding the bids received for the oil blocks. When asked about this, the Vice President said it would be “premature” to release details on the bids before the evaluation is completed.

“I think it is premature now to reveal who bid for what before the evaluation is done, but we gave you a lot of information. You know which of the blocks have bids,” Jagdeo said at a recent media briefing.

Bid round’s success

Deakin issues like the delay of the bid round did nothing to mar the process. Because it was Guyana’s first, he explained that “delays were expected.”

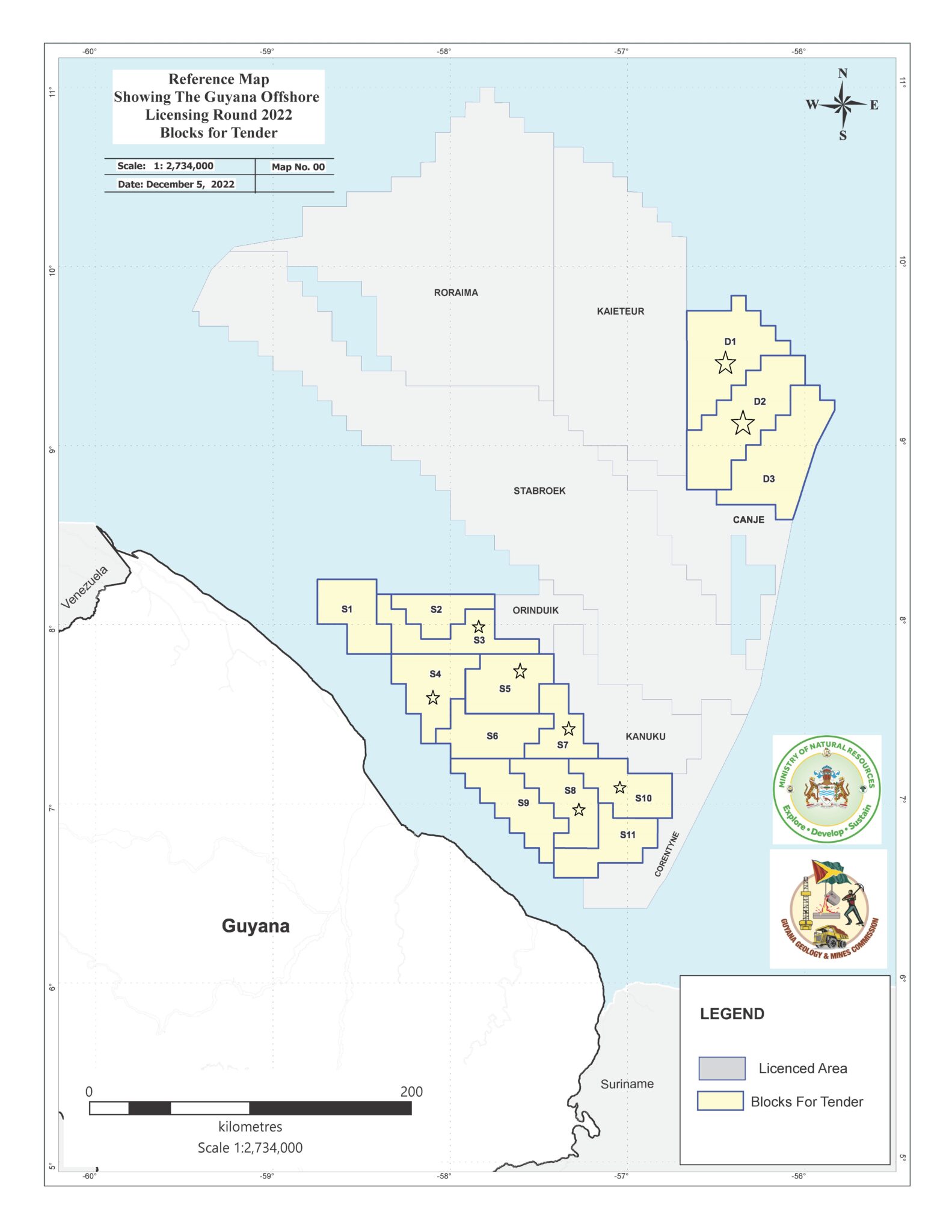

He noted too that the prospects up for grabs were a “bit riskier” so considering the fact that Guyana got bids for eight blocks, the round was a success.

All 14 Guyana oil blocks attract interest as model PSAs released | OilNOW

“These blocks require a significant amount of capital so in a time of high interest rates, the energy transition window closing in, I think that the round was quite successful,” he commented.

Deakin compared a recent offshore bid round in neighboring Brazil where only four of the 11 blocks were acquired.

With a lot of investor interest on Guyana, it was expected that the country would get a high number of bids. Big names like Shell and Chevron had noted interest in the early days of the licencing round but did not make any bid submissions.

Majors ExxonMobil and TotalEnergies, which already have interests in the jurisdiction, are among the bidders.

The groups are: TotalEnergies, Qatar Energy, and Petronas; Delcorp Inc., Watad Energy and Arabian Drillers; ExxonMobil, Hess, and CNOOC; Liberty Petroleum Corporation and Cybele Energy; Sispro Inc.; and International Group Investment Inc. and Montego Energy.