Chevron announced total earnings of US$2.25 billion in the fourth quarter (Q4) of 2023, reflecting a 64.4% drop from the US$6.35 billion reported in the same period in 2022.

Chevron in its Feb. 1 financial report said the decline was primarily attributed to lower upstream realizations, losses from decommissioning obligations, and higher impairment charges. Chevron faced substantial losses due to decommissioning obligations for assets previously sold in the U.S. Gulf of Mexico, amounting to US$1.9 billion. Additionally, the company recorded US$1.8 billion in U.S. upstream impairment charges, with a notable impact from operations in California. Lower margins on refined product sales also contributed to the downturn in earnings.

Chevron’s strategic move bolsters Guyana’s global oil dominance, says Sankey President | OilNOW

Despite the decrease in earnings, Chevron reported annual records for worldwide and U.S. net oil-equivalent production. A 4% increase in worldwide annual production, exceeding 3.1 million barrels of oil equivalent per day, was driven by the acquisition of PDC Energy and growth in the Permian Basin, the company said.

Investments in the sector rose significantly, with Chevron’s capital expenditure (CAPEX) in 2023 increasing by 32% compared to the previous year. This rise was primarily due to higher investments in the U.S., including significant spending on PDC assets post-acquisition and the acquisition of a majority stake in ACES Delta, totaling approximately US$1.1 billion.

However, the company’s cash flow from operations saw a downturn influenced by lower commodity prices and reduced margins on refined product sales. Despite this, cash returned to shareholders reached more than US$26 billion for 2023, marking an 18% increase from the previous year.

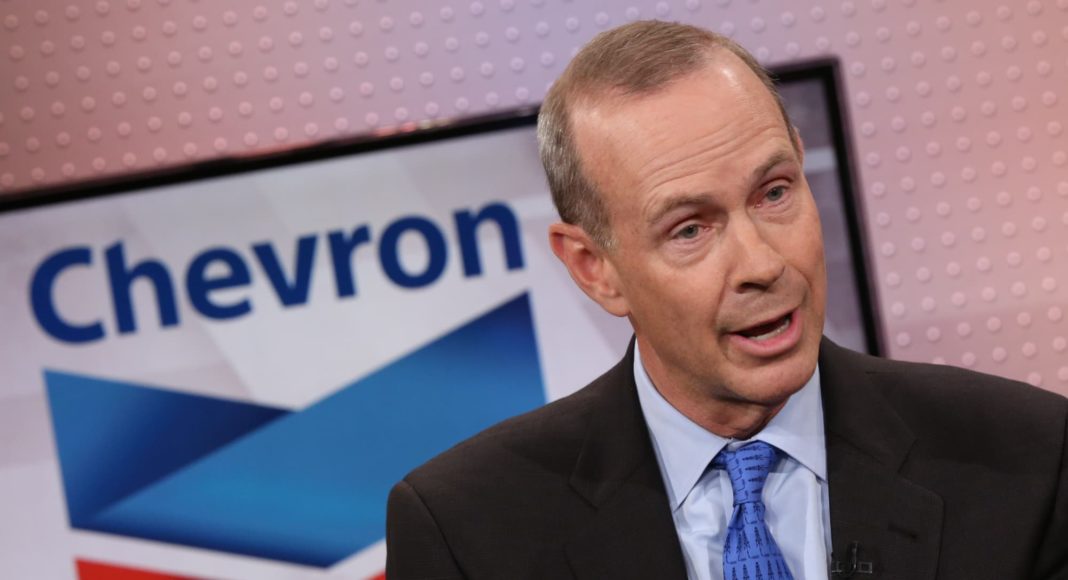

Mike Wirth, Chevron Chairman and Chief Executive, commented on the company’s performance, stating, “In 2023, we returned more cash to shareholders and produced more oil and natural gas than any year in the company’s history. We also strengthened our portfolio with traditional and new energy acquisitions to help meet the growing demand for affordable, reliable, and ever-cleaner energy.”

In 2023, the company announced its acquisition of Hess Corp. giving it access to the ExxonMobil-operated Stabroek block in Guyana. This license is an extraordinary asset with industry-leading cash margins and low carbon intensity that is expected to deliver production growth into the next decade.