Noble Corporation said its earnings for the fourth quarter of 2022 are expected to be between US$140 million and US$150 million. This was revised downward from the previous outlook of US$155 million and US$175 million. The reduction is primarily related to the previously reported mechanical issues on the Noble Regina Allen.

In its financial update, Noble said the figure represented Adjusted Earnings before Interest, Taxes, Depreciation, and Amortisation (EBITDA) for the fourth quarter. In accordance with Danish legal and stock exchange requirements, the company has not completed its preparation of audited financial statements for the quarter, and it determined, these numbers based on preliminary results.

As of December 31, 2022 Noble’s debt was US$673 million and cash and cash equivalents was US$470 million, resulting in a net debt balance of US$203 million. During the fourth quarter, Noble executed on over US$85 million of share repurchases (including the compulsory purchase of legacy Maersk Drilling shareholders in November and open market share repurchases conducted during December pursuant to Noble’s previously announced share repurchase program).

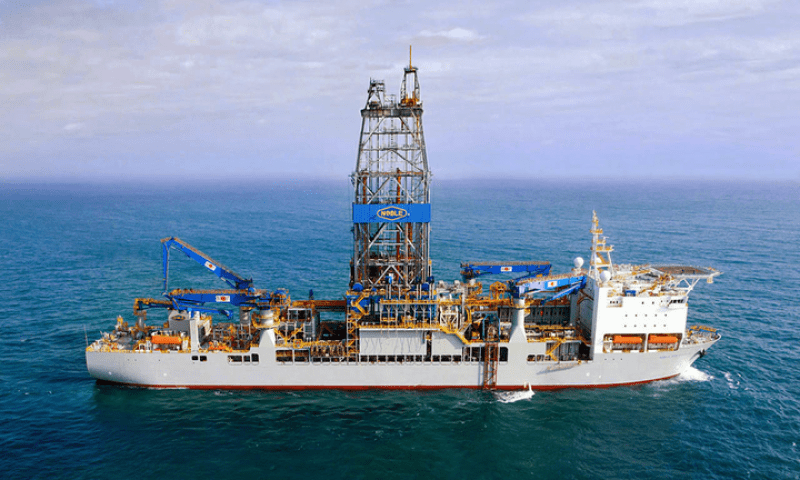

Noble also provides the following operational and contracting updates. The drillship Noble Gerry de Souza is expected to commence a new contract in Nigeria with an undisclosed operator with a firm duration of nine months and with unpriced options extending into Q3 2024.

The drillship Noble Stanley Lafosse has received a commitment from an undisclosed operator for a six-well work program in the US Gulf of Mexico. This scope is expected to commence around June 2023 and is expected to keep the rig busy until mid-2024. This contract also includes five one-well operations options at mutually agreed day rates. The firm backlog associated with the contract is estimated to be approximately US$148 million.

The drillship Noble Faye Kozak has been awarded a one-well contract with Kosmos in the US Gulf of Mexico with a minimum duration of 50 days at a day rate of US$450,000. This contract is scheduled to commence in Q2 or Q3 2023 in direct continuation of the rig’s current work. Additionally, QuarterNorth Energy has exercised one option well, with one option well remaining.

The drillship Noble Globetrotter I is expected to commence its previously disclosed contract with Petronas in Mexico in late January, later than previously anticipated due to permitting delays. Additionally, the rig has been awarded a new contract with an undisclosed operator for 70 days of plug & abandonment work in the US Gulf of Mexico, which is planned to commence in July 2023.

The jackup Noble Regina Allen experienced a mechanical failure with the jacking system on one of its legs. The rig has been safely demobilised to a port in Trinidad with repair plans under development. The rig has been off day rate since mid-December and its contract has been terminated due to extended downtime. While the rig has standard insurance coverage pertaining to repairs, there is no insurance for loss-of-hire. Noble said its efforts are focused on repairing and positioning the rig for potential redeployment in the second half of 2023, although timing is uncertain.

Noble, which has the most rigs on contract with ExxonMobil for its Stabroek Block operations in Guyana, remains one of the world’s leading offshore drilling contractors for the oil and gas industry.

Over 900 people on six rigs supporting safe drilling operations offshore Guyana – Routledge

The Maersk Discoverer, now styled Noble Discoverer, is also conducting exploration drilling at the Wei-1 well for CGX Energy, offshore Guyana.

The company recently merged with Maersk Drilling.