Maersk Drilling announced Wednesday that it has entered into a definitive agreement to combine with Noble Corporation in a primarily all-stock transaction. The combined company will be named Noble Corporation, and its shares will be listed on the New York Stock Exchange and Nasdaq Copenhagen. The transaction is targeted to close in mid-2022.

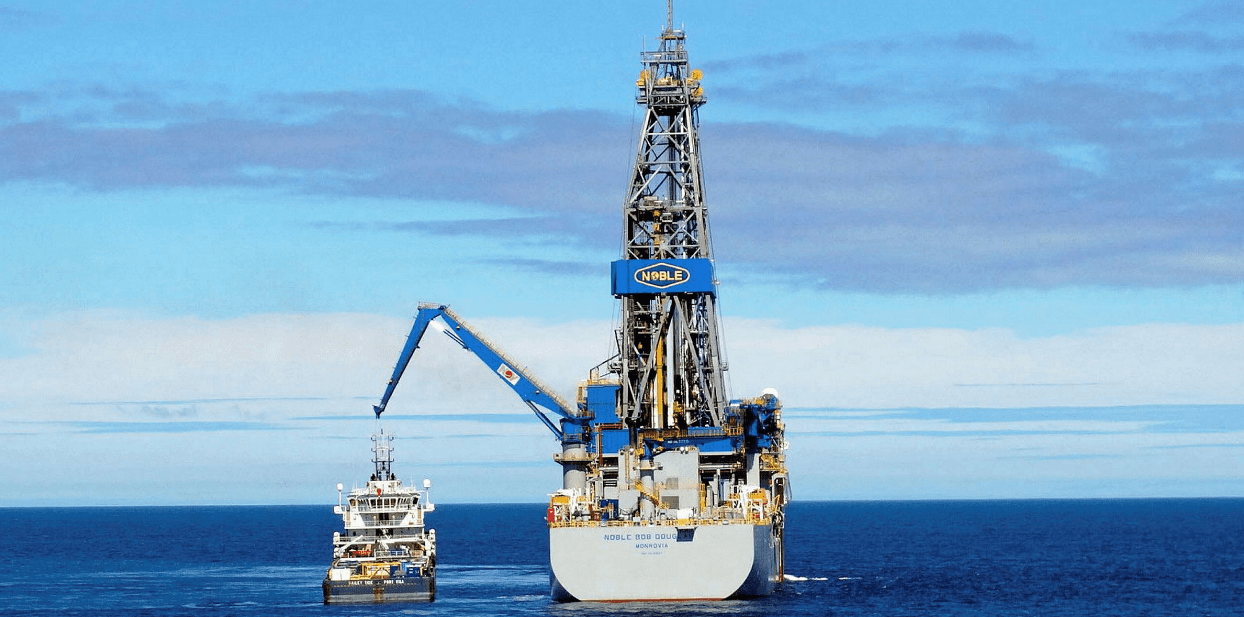

Maersk Drilling said in an update that both companies share a very strong conviction in the compelling industrial logic behind the creation of a world class offshore driller with the scale, capabilities, and resources to successfully serve a broad range of customers. The combined company will own and operate a modern, high-end fleet of floaters and jack-up rigs across benign and harsh environments, serving customers in the most attractive offshore oil and gas basins. The transaction will unite the strong capabilities and decades of experience of Noble and Maersk Drilling, leveraging their differentiated value propositions and unwavering commitments to best-in-class safety and service quality.

Driller with most rigs offshore Guyana seeking services from local contractors

The business combination agreement has been unanimously approved by the Boards of Directors of Noble and Maersk Drilling, and it is also supported by major shareholders of both companies, including Noble’s top three shareholders, which collectively currently own approximately 53% of Noble shares, and APMH Invest A/S, which currently owns approximately 42% of the share capital and votes of Maersk Drilling. In addition, certain foundations related to APMH Invest A/S, which currently own approximately 12% of the share capital and votes of Maersk Drilling, have expressed their intention to support the transaction.

“This combination carries strong industry logic. With the combination we are creating a differentiated provider of offshore drilling services, which will be able to enhance the customer experience through increased scale, global reach, and industry-leading innovation,” said Maersk Drilling’s Chairman of the Board, Claus V. Hemmingsen.

Hemmingsen said the combination will create value for all shareholders and will offer investors a unique opportunity to benefit from the market recovery, a robust financial position and strong free cash flow potential, all paving the way for the potential return of capital to shareholders.

According to A.P. Moller Holding CEO Robert Uggla, in 2016, the company instigated the restructuring of A.P. Moller – Maersk and the renewal of the A.P. Moller Group. As part of such restructuring, Maersk Drilling was demerged from A.P. Moller – Maersk with the objective to establish an independent company with a capable, focused Board and to actively participate in the required consolidation of a distressed drilling industry.

“The combination of Maersk Drilling and Noble creates a drilling company with a stronger customer proposition building on the companies’ extensive operational capabilities. The combined company will hold an industry leading balance sheet, significant cost synergies, a modern fleet and with access to an international shareholder base,” Uggla said.

Maersk Drilling CEO Jørn Madsen said Noble is the right match for Maersk Drilling, and the combination makes a lot of sense. “I’m proud that Maersk Drilling’s strong heritage in the North Sea, unparalleled operational excellence and competencies, industry-leading sustainability position and commitment to innovation will contribute to creating a world class driller with an unmatched expertise within deepwater and harsh environment drilling. In the short term, the combination will, unfortunately, impact our organisation, but it will also create a larger and stronger company, which will provide future opportunities for growth and new jobs.”

Noble says rig crews working in Guyana delivering outstanding performances

The combination is expected to generate potential cost synergies of USD 125 million per year with full potential to be realized within two years after closing of the transaction. The combined company will benefit from a diverse revenue mix, a robust contract backlog with significant earnings visibility, a solid balance sheet, and a strong free cash flow potential, supporting the potential for return of capital to shareholders while providing resiliency through the industry cycle.

Leadership, locations and listing

The combined company will have a seven-member Board of Directors with balanced representation from each of Noble and Maersk Drilling. Initially, the Board of Directors will be comprised of three directors appointed by Noble and three directors appointed by Maersk Drilling, one of whom will be the current Chairman of the Board of Maersk Drilling, Claus V. Hemmingsen. Noble and Maersk Drilling will jointly appoint Charles M. (Chuck) Sledge the Chairman of the Board of Directors of the combined company.

It has been agreed that Robert W. Eifler, Noble’s President and CEO will become President and CEO of the combined company upon closing of the transaction. Robert W. Eifler will also be a member of the Board of Directors.

The combined company will be headquartered in Houston, Texas, and will maintain a significant operating presence in Stavanger, Norway, to retain proximity to customers and support operations in the Norwegian sector and the broader North Sea, and to ensure continued access to talent.

Transaction terms and structure

The combination is a primarily all-stock transaction where the shares of the combined company will be distributed equally between the current shareholders of Noble and Maersk Drilling. The transaction will be implemented through an English incorporated holding company, which will make a voluntary tender exchange offer to the shareholders of Maersk Drilling. The tender exchange offer will allow Maersk Drilling’s shareholders to exchange each Maersk Drilling share for 1.6137 shares in the new holding company. Upon the closing of the transaction, the shareholders of Maersk Drilling and Noble will each own approximately 50% of the outstanding shares of the new holding company.

Exxon firms up contract coverage for Noble drill ships targeting Guyana operations

Although the agreement primarily is an all-stock transaction, Maersk Drilling shareholders will have the ability to elect to receive cash instead of shares in the new holding company for up to USD 1,000 paid in DKK, subject to an aggregate cash consideration cap of USD 50 million (excluding any cash paid for fractional shares). As a consequence, Maersk Drilling shareholders’ overall shareholding in the new holding company upon completion of the offer may be reduced below 50% to the extent that Maersk Drilling shareholders choose to elect the cash option over shares.

The offer and disclosure documents to be distributed to Maersk Drilling shareholders are expected to be published in the first half of 2022.