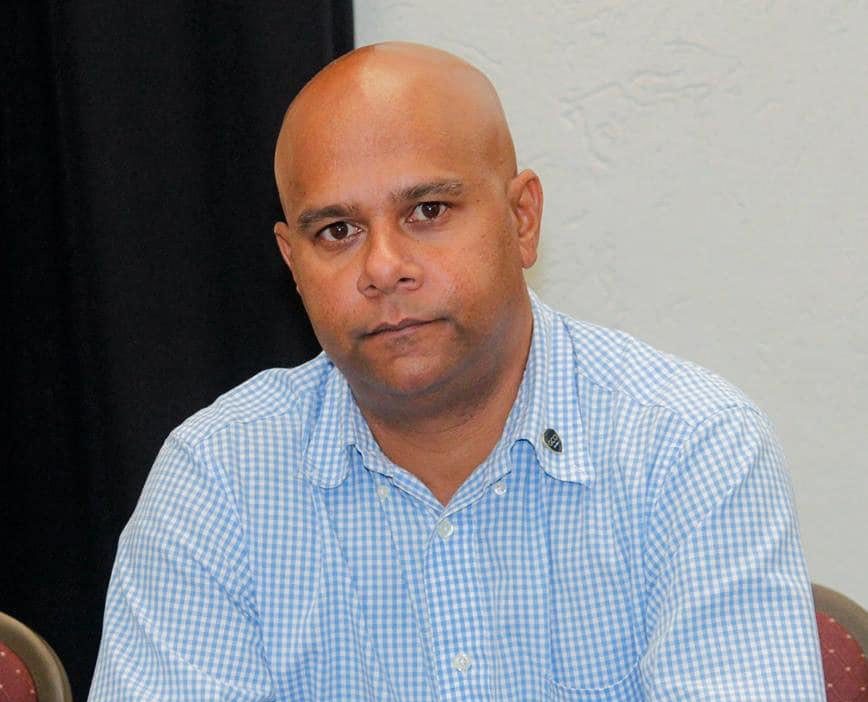

President of the Georgetown Chamber of Commerce and Industry (GCCI), Timothy Tucker said the organisation is lobbying the Guyana government to pursue the type of legislative changes that would allow new companies to use their contracts as a means of securing loans.

Given discussions that were had, Tucker said the administration has signalled its interest to get the proverbial ball rolling on this matter.

The GCCI President said there are some legal kinks that need to be ironed out while adding that Attorney General and Minister of Legal Affairs, Anil Nandlall S.C, and Finance Minister, Dr. Ashni Singh are aware of these.

To help small and medium-scale enterprises overcome challenges with access to finance, some oil-producing States have created Local Content Funds. These accounts hold deposits from major oil players. That account is then used to support/subsidise companies with the capital they need to tap opportunities in the industry.

While the City Chamber is open to such an approach, he has concerns about the sustainability of such an arrangement.

Tucker said, “We would definitely like to see something like a Local Content Fund but at the end of the day, you have to question how sustainable it is. What happens if the oil prices drop? I strongly believe that the private sector should not be relying on the government to fund it. We should have the mechanisms to create the enabling environment for access to finance.”

Tucker was keen to note as well that the business community also needs to get its act together as regards financial accountability. He said this was recently raised by Dr. Singh as an issue that concerns the banking sector.

“He said to us that the private sector needs to be honest about their business and being honest about your business means reporting your correct earnings,” the GCCI President said.

He added that businesses cannot, for example, be practicing under-invoicing and still expect the risk-averse banking sector to be welcoming and open to doling out loans.

Guyana and Suriname: How access to capital can transform frontier energy markets | OilNOW

“So, these are some of the things that we also from the private sector really have to start looking at and say; ‘listen, we need to regularise ourselves and run our businesses properly, with structure’,” the GCCI Head stated.

He said it is true that the banking industry has been reluctant to lend but companies must also do their part going forward to ensure their books are in order