Financial information services provider Fitch Solutions says the first oil discovery outside the Stabroek block will serve to buoy investor sentiment to projects in deepwater Guyana more broadly while pointing out that the positive outlook for oil and gas production will drive real GDP growth higher over the next 10 years.

On August 12, Tullow Oil announced a new oil discovery – its first in the Orinduik block off the coast of Guyana. The well holds 55m net oil pay and the logging data confirms higher recoverable oil resource estimate than the pre-drill forecast. As the first project outside of the Stabroek block; the Jethro-1 discovery will encourage further exploratory programs in the Orinduik and Kanuku, an adjacent block,” Fitch Solutions said in a report published this week.

After the successful discovery at Jethro-1, Tullow Oil plans to start drilling a second well, Joe-1, in August.

Fitch said the Orinduik discovery adds to the momentum building up for the country as Qatar Petroleum acquired a stake in Total’s participating interest in both of these two blocks in July. In August, Canadian CGX Energy received the approval to move forward with the work programme in the Corentyne block.

Oil Sector Will Fuel Economic Growth

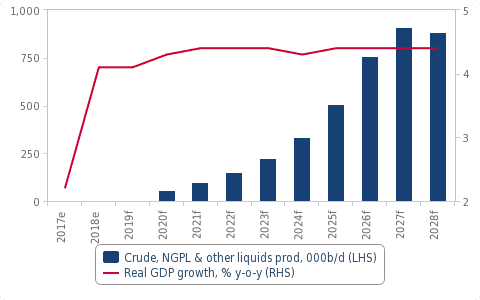

“The positive outlook for oil and gas production to begin in 2020 will drive real GDP growth higher in the next 10 years,” Fitch said.

Fueled by mega oil discoveries and production set to hit close to 1 million barrels per day by the mid-2020s, the South American country has been listed at number 1 among the 5 fastest growing economies in the world.

Local Content Development

ExxonMobil, which has been active in Guyana since 2008, plans to produce first oil from its Liza 1 and Liza 2 Development projects, located in the Stabroek block, in 2020 and 2022, respectively. Earlier this year, the oil and gas giant announced its 13th offshore discovery in the Stabroek block, which lifted the estimate of Guyana’s offshore recoverable reserves to over 6 billion barrels of crude oil.

“As it prepares for an influx of energy royalties in 2020, the Guyanese government will increase public expenditures directed into public infrastructure given the country deficiencies in its transport network and electricity grid.

In addition, ExxonMobil has launched development programs to train and hire Guyanese nationals in the energy sector, boosting domestic employment,” Fitch said.

The company has said to date 1,357 Guyanese are working in the oil and gas industry which represents close to 50 percent of the workforce.

Guyana Offshore Remains Attractive

Fitch said Guyana’s offshore opportunities will remain attractive for oil companies despite the lack of a regulatory agency to oversee the oil and gas industry. The increasing interest among oil producers, underpinned by the discovery surpassing expectations in the Orinduik block, proves the potential of Guyana’s offshore fields.

“However, we caution that the absence of a market regulating body may leave the sector underdeveloped and inefficient. The most recent amendment to the Petroleum Act was made in 1992, and the only entity overseeing Guyana’s oil and gas industry is the Department of Energy. On the back of a poor regulatory system, the industry is prone to the abuse of power,” Fitch warned.

In spite of potentially higher future royalties and the imminent establishment of a local content policy, Fitch believes the next bidding round will remain attractive to oil companies based on the previously successful exploration efforts.

“We expect that even a doubling of the current [royalty] rate will not discourage oil producers, especially after the recent oil discovery, which further lowered the risks of exploratory projects outside of the Stabroek block,” Fitch said.

While financial information agency said there is a risk that the local content requirements can increase oil production costs or simply be unrealistic given the lack of industrial development, it pointed out that local content policy is common among developing economies eager to develop local technical capabilities and boost employment.