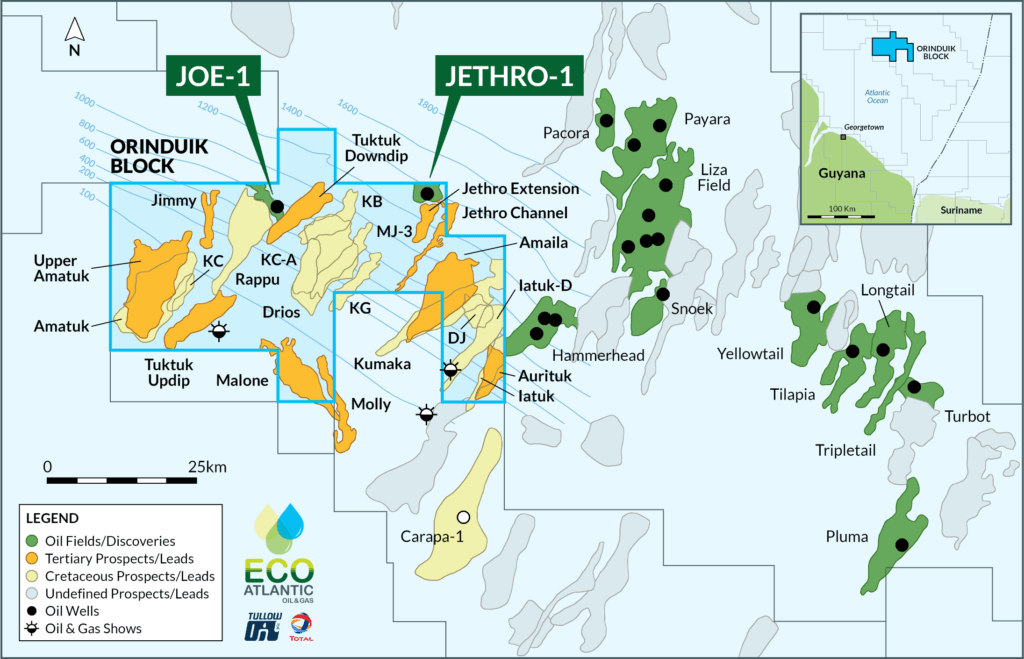

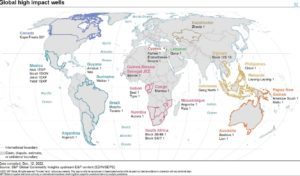

S&P Global expects the Amatuk prospect in the Orinduik Block to be the exploration target of Tullow Oil in 2023. The analyst firm named Amatuk in its high impact well (HIW) drilling outlook for 2023, alongside CGX’s Wei-1 well in the Corentyne Block.

A 2018 Competent Persons Report (CPR) by Gustavson Associates had estimated the block to hold 2.9 billion barrels of oil-equivalent prospective resources. It had said that the Amatuk lead is above a channel infill of Upper Cretaceous age, that runs from the southwest of the acreage to the north where it plunges onto the continental shelf. It had estimated the lead would be about 68 square kilometres (km2), with 228.9 million oil-equivalent barrels and a 19.2% probability of success (POS).

In the 2020 updated CPR, the estimate for the Block moved to 5.1 billion oil-equivalent barrels. The estimate for Amatuk increased to 267.3 million oil-equivalent barrels and a 28.8% POS. The update followed new data from heavy oil discoveries at the Jethro and Joe wells.

A 2022 report by Letha C. Lencioni of WSP USA Inc. estimated the Block to hold 8.1 billion barrels. This means Amatuk likely got an increased estimate in its revision, but the published report did not state.

Amatuk is expected to be drilled in the second renewal period of the license. The Orinduik Block partners were encouraged by recent nearby discoveries made by ExxonMobil in the Stabroek Block.

According to the website of Eco (Atlantic), Tullow’s Orinduik Block partner, the first renewal period of the license comes to a close on January 12, 2023. The license requires a relinquishment of 20% of the acreage, which would see the consortium parting with approximately 360 square kilometers of the 1,800 km2 acreage.

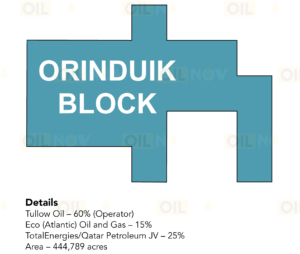

The Orinduik Block lies 170 kilometers (km) offshore. Tullow owns 60% operating interest, while Eco-Atlantic has 15% working interest and TotalEnergies/Qatar Energy JV has 25%.